Ferraris, yachts, jets and jewels: Loan fraud rampant under SBA COVID aid program

Biden administration blames Trump for undue haste in distributing pandemic aid, claims credit for restoring program controls.

The Golden Horseshoe is a weekly designation from Just The News intended to highlight egregious examples of wasteful taxpayer spending by the government. The award is named for the horseshoe-shaped toilet seats for military airplanes that cost the Pentagon a whopping $640 each back in the 1980s.

This week's Golden Horseshoe is again awarded to the Small Business Administration for its administration of the fraud-riddled Paycheck Protection Program, as a continuing stream of criminals face prosecution for gaming the system.

An estimated $84 billion of $800 billion in PPP program loans has been issued fraudulently, the House Select Subcommittee on the Coronavirus Crisis found.

One recent case involved a Riverside County, Calif. man who was found guilty of wire fraud charges after using hundreds of thousands of dollars from PPP loans for personal expenses, according to the Department of Justice.

Oumar Sissoko, 59, purported to own a pothole-repair company, claiming he was in the process of hiring 450 full-time employees with $2.9 million in average monthly payroll expenses. In applying for the PPP loan, he claimed he would use the funds to retain workers, maintain payroll and other business-related expenses such as utility, lease and mortgage interest payments.

Instead, Sissoko used loan proceeds to splurge on a $113,000 Mercedes Benz, pay off a BMW loan, and make a down payment of approximately $100,000 toward purchase of a company.

In another loan scheme targeting the COVID relief program, an Oklahoma woman has admitted to conspiring to submit at least 153 fraudulent PPP applications seeking $43.8 million between May 2020 and June 2021, according to the DOJ.

Amanda Gloria, 45, filed falsified information on behalf of at least 111 entities, which received approximately $32.5 million. She personally received approximately $1.7 million.

Gloria has pleaded guilty to charges of conspiracy to commit bank fraud and money laundering. Scheduled to be sentenced in July, she faces up to 30 years in prison on the conspiracy charge and up to 10 years for money laundering.

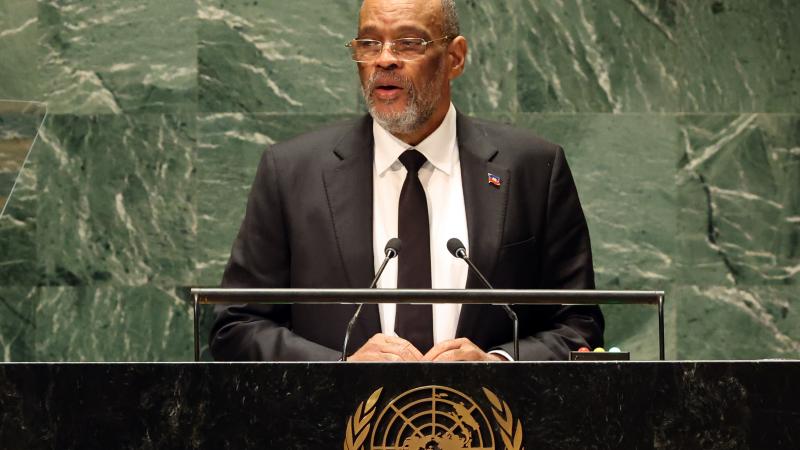

The CEO of a PPP lending institution, meanwhile, has been arrested "on multiple fraud charges and aggravated identity theft" for using false loan and lender applications to get SBA approval to be a non-bank lender in the PPP Program, according to U.S. law enforcement. Rafael Martinez collected over $71 million in lender fees and also lied to the SBA to get his own company approved for a PPP loan, alleges the U.S. Attorney for the Southern District of New York. He used the proceeds from the lender fees to buy a villa in the Dominican Republic, a Ferrari, and private jets.

In yet another case, a convicted felon was indicted for submitting falsified documents to receive PPP and other COVID-19 relief loans, the IRS recently reported.

Between March 2020 and April 2021, Daniel Joseph Tisone of Naples, Fla. "submitted false and fraudulent Economic Injury Disaster Loan (EIDL), Main Street Lending Program (MSLP), and Paycheck Protection Program (PPP) loan applications to the Small Business Administration, as well as PPP and MSLP approved lenders," according to the IRS. "The loan applications contained numerous false representations, including the criminal history, average monthly payroll, number of employees, and gross revenues of the applicant, Tisone."

The government intends to confiscate "a 2019 Tiara 34LS boat, two real properties located in Naples, a 4.02 carat solitaire engagement ring, approximately $65,645.69 seized from two bank accounts, and approximately $2,617,447.17, which are alleged to be traceable to proceeds of the offense," according to the IRS.

The SBA blames the chronic fraud in the PPP program on undue Trump administration haste to process COVID relief funds during the economic emergency precipitated by nationwide government-ordered business shutdowns in 2020 during the early months of the pandemic.

"The Trump administration prioritized speed over certainty, a choice that left the door wide open to fraudsters, exposing taxpayer dollars to fraud, waste, and abuse," an SBA spokesperson told Just The News via email. "The Biden-Harris Administration immediately got to work to make sure more small businesses could use our services while also implementing a number of control measures to prevent fraud risks that had been allowed to escalate.

The administration claims credit for restoring fraud controls and accountability in COVID relief lending. "From the outset, the Biden-Harris Administration has worked closely with the Inspector General to identify and address all areas of concern, including referrals to law enforcement where appropriate," the spokesperson said. "SBA's work to enhance fraud controls in pandemic programs has been recognized by federal accountability agencies and watchdogs. These new efforts, including the appointment of a new special counsel for enterprise risk and the creation of the Fraud Risk Management Board, will expand that approach, as SBA continues to undertake measures to ensure the integrity of its programs."

Two of the four recent cases reported above involved fraudsters who obtained PPP and other pandemic relief loans in 2020 and 2021, under both the Trump and Biden administrations.