Governors pan SEC climate disclosure proposal as unprecedented federal overreach

Rule will harm businesses and investors by increasing compliance costs and placing uncertain and immaterial information in disclosure statements, the governors argued.

(The Center Square) -

Sixteen Republican governors are asking the Biden administration to withdraw a proposed rule by the U.S. Securities and Exchange Commission that would require companies to disclose some climate-related information in annual reports and registration.

The governors called the move an "unprecedented level of federal overreach" in a letter sent Tuesday to President Joe Biden and SEC Commissioner Gary Gensler.

"The proposed rule will harm businesses and investors in our states by increasing compliance costs and by larding disclosure statements with uncertain and immaterial information that the federal government – let alone the SEC – is not equipped to judge," the governors said in their letter.

The governors said it's OK for companies to disclose the information voluntarily.

"However, since climate change models vary dramatically, the notion of evaluating investment risk based on such uncertain variables is inherently subjective and unreliable," they wrote. "Moreover, such disclosures would serve to confuse investors as to how to judge true financial risk, significantly reducing market efficiency. It is precisely the type of question where government should not impose its own judgments of what constitutes material risk in place of managers."

The rule "appears part of an ongoing effort across the federal government to penalize companies involved in traditional energy development," the governors said.

"Until recently, the Biden administration explicitly refused to issue new oil and gas leases on federal lands and is now considering only a fraction of the lands that should be available," they wrote. "In addition, the Council on Environmental Quality is rolling back reforms to the environmental review process, the President has denied key pipeline and other permitting applications, and officials throughout the Biden Administration are rhetorically discouraging investment in oil and gas development."

SEC officials said companies are interested in climate-related information.

"The results of multiple recent surveys indicate that climate risks are among the most important priorities for a broad set of large asset managers," the SEC said in its 140-page report. "PWC reported in their Annual Global CEO Survey that in 2016, only 39% of asset and wealth management CEOs reported that they were concerned about the threats posed by physical risks brought about climate change, whereas this figure increased to 70% in 2021."

The SEC extended the comment period on the proposed rule from May 20 to June 17. The commission is accepting electronic comments.

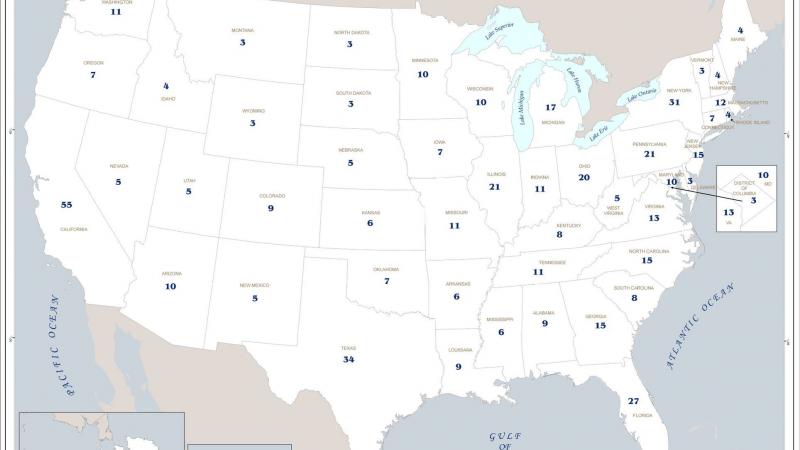

The letter is signed by Kay Ivey of Alabama, Mike Dunleavy of Alaska, Doug Ducey of Arizona, Asa Hutchinson of Arkansas, Brad Little of Idaho, Kim Reynolds of Iowa, Tate Reeves of Mississippi, Mike Parson of Missouri, Greg Gianforte of Montana, Pete Ricketts of Nebraska, Doug Burgum of North Dakota, Kevin Stitt of Oklahoma, Kristi Noem of South Dakota, Greg Abbott of Texas, Spencer Cox of Utah and Mark Gordon of Wyoming.