Insidious debt 'going to eat at our national income, like termites,' warns budget expert

"We can debit people's bank accounts without touching them because all we do is print more money," says Marc Goldwein. "Your bank account stays with the same dollar amount, it becomes worth less." Goldwein says average Americans should care about the nation's rising deficit and debt: "What's going to happen is your income is just going to grow a little bit slower than it otherwise would each year, year after year, and so you might not feel it at any moment in time, but it accumulates and ultimately can create a lot of pain."

Marc Goldwein, senior vice president and senior policy director for the Committee for a Responsible Federal Budget, told Just the News that the record deficit spending the federal government is engaged in is essentially like debiting Americans' bank accounts.

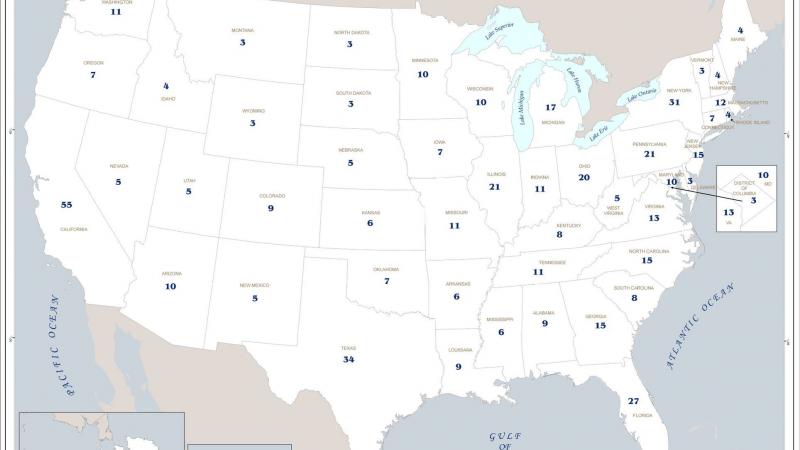

The Congressional Budget Office reported this week that the federal coronavirus spending is driving the deficit to a record $3.3 trillion this year. The national debt held by the public is estimated to exceed the size of the entire economy by 2021.

"Basically, the coronavirus has advanced our fiscal despair by a decade," Goldwein said in an interview. "We were projected to have debt exceed the size of the economy by about 2031. Instead, that's going to happen by 2021. We were expected to reach a new record of debt in the 2030s, instead by 2023 debt is going to exceed its World War II levels. The coronavirus and mainly the response to the coronavirus and the economic downturn has made the debt dramatically worse and basically lost us a decade."

Goldwein warned that the rising debt is not sustainable.

"The growth in our debt is not sustainable in the long run," he said. "Right now, we are facing an unprecedented crisis — a mixture of a very weak economy and a very painful pandemic — that is totally appropriate to borrow for, it's totally appropriate to spread the pain over time.

"But underlying that new borrowing, we already had debt at a post-war record level, and it's projected to rise as a result of rising health and retirement costs, and that cannot continue indefinitely. No country can continue to have a debt rise faster than its output on a permanent basis."

Just the News asked Goldwein if the average American should be concerned about how the record deficit and debt affect them.

"What's going to happen is the debt kind of slowly is going to eat at our national income, like termites, and so 30 years from now, for example, based on CBO projections, everybody's income is going to average about $10,000 per person less, if we let the debt rise dramatically, as opposed to if we fix it," he said.

"It's not going to be a $10,000 cut in your income," Goldwein said. "What's going to happen is your income is just going to grow a little bit slower than it otherwise would each year, year after year, and so you might not feel it at any moment in time, but it accumulates and ultimately can create a lot of pain."

He described the rising deficit piling onto the national debt as essentially debiting Americans' bank accounts.

"So here's the beautiful thing about having a central bank," Goldwein said. "We can debit people's bank accounts without touching them because all we do is print more money. Your bank account stays with the same dollar amount, it becomes worth less. So the fact that we print our own currency means we'll never literally have to debit people's bank accounts. Worst case, we can just devalue them, and that's sort of, in some ways, the distinction without a difference."

Goldwein said Congress has given the Federal Reserve a great deal of power during the coronavirus pandemic, which has led to about $2.3 trillion worth of "unprecedented" intervention in the U.S. economy to date.

"Most of what they've actually done so far is buy U.S. treasuries and, to a lesser extent, mortgage-backed securities," he said. "Since the crisis started, the Federal Reserve has bought over $2 trillion of Treasury securities and mortgage-backed securities, about one and a half trillion of that coming from from treasury bonds."