IRS blasted by watchdog for ‘horrendous’ customer service

Taxpayer Advocate Service ranked the most serious problems taxpayers face, starting with "excessive processing and refund delays."

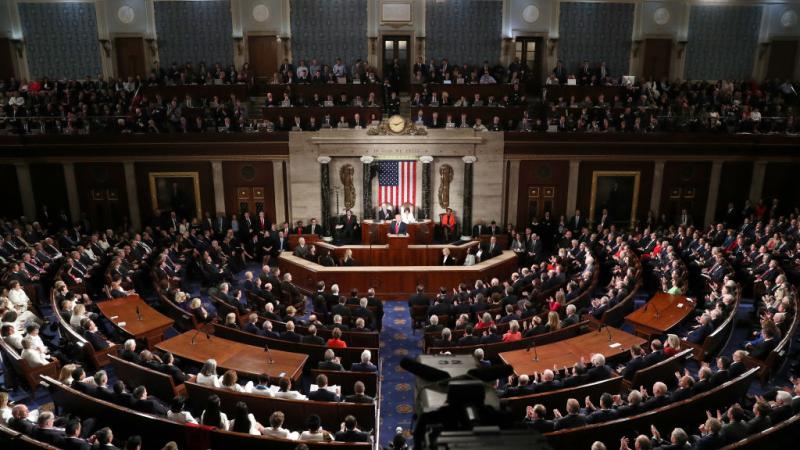

Taxpayer Advocate Service (TAS), an independent watchdog within the Internal Revenue Service, released a 2021 report to Congress stating that tens of millions of taxpayers had a "horrendous" experience with customer service, including the worst phone service "ever" and long delays for refunds.

"Calendar year 2021 was surely the most challenging year taxpayers and tax professionals have ever experienced – long processing and refund delays, difficulty reaching the IRS by phone, correspondence that went unprocessed for many months, collection notices issued while taxpayer correspondence was awaiting processing, limited or no information on the Where’s My Refund? tool for delayed returns, and – for full disclosure – difficulty obtaining timely assistance from TAS," the report stated.

Taxpayer advocate Erin Collins stated: "There is no way to sugarcoat the year 2021 in tax administration: From the perspective of tens of millions of taxpayers, tax administration did not work for them."

TAS ranked the most serious problems taxpayers face, starting with "excessive processing and refund delays," followed by a "lack of sufficient and highly trained" IRS employees.

Other issues mentioned are delays with telephone and in-person service due to the COVID pandemic, lack of transparency and that low-income taxpayers face issues with IRS collection payment policies and communication.

At the conclusion of the 2021 filing season, the IRS still had a backlog of 35 million returns as millions remain unprocessed still. The agency had more than 10 million individual and business returns in its Error Resolution System, a 544% increase from 2020 to 2021.

The IRS received a record 282 million calls in 2021, but customer service was only able to answer about 11% of those calls, which had an average hold time of 23 minutes.

TAS recommends that Congress allocates more funding for the IRS and expand the jurisdiction of the tax court for refund cases.