White House predicts deficit will shrink, debt-to-GDP improve early next year

"Those deficits are not going to look anywhere near the size they are," said Joe LaVorgna, chief economist at the National Economic Council. "And as that happens, your debt-to-GDP also won't look as bad. So they're really kind of interconnected."

The White House predicts the federal deficit will shrink and the U.S. debt-to-GDP ratio will improve early next year as the national economy continues to reopen and recover after the worst of the COVID-19 pandemic this spring.

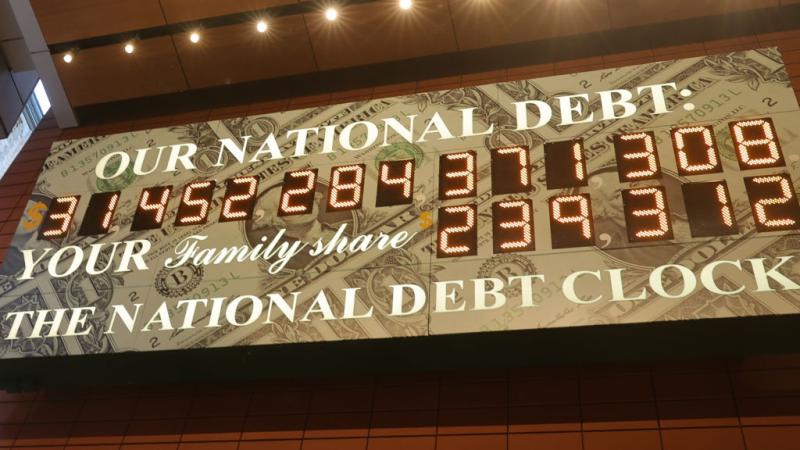

The U.S. deficit is projected to hit a record $3.3 trillion this year, and the national debt will exceed the size of the U.S. economy by 2021, according to a Congressional Budget Office report published Wednesday. The record deficit is projected to drive the "federal debt held by the public" to 98% of GDP in 2020, "compared with 79 percent at the end of 2019 and 35 percent in 2007, before the start of the previous recession."

Joe LaVorgna, chief economist of the National Economic Council, told Just the News in an interview at the White House Thursday that the debt-to-GDP ratio has risen because of rising deficits due to the pandemic economic contraction. As the economy returns to normalcy, likely by early next year, "those deficits are not going to look anywhere near the size they are, and as that happens, your debt-to-GDP also won't look as bad," LaVorgna said. "So they're really kind of interconnected."

The CBO also warned Wednesday that the balances in three federal trust funds — Social Security, Medicare and the Highway Trust Fund — will be "exhausted within the next 10 years" without congressional action. The nonpartisan CBO stated that the projections for deficits were "revised upward in part because of the economic disruption stemming from the 2020 coronavirus pandemic, which reduced CBO's estimates of payroll tax revenues."

LaVorgna said President Trump was aware of the problem and is tackling it by a return to economic growth that would refill government coffers. He said the need for government spending was offset to some degree by low borrowing costs due to low interest rates.

"The President knows he's got to get the economy back the way it was," LaVorgna said. "And he's made tremendous progress in doing so, and if you get growth, you're going to get revenue. Now isn't the time to worry about the deficit. The deficit is a function of the fact that the economy was forced to close because of the pandemic. Interest rates are low here, they're low globally. Now is the prudent time to take action, such as the CARES Act the administration passed in record time and speed and scope back in March that was used to get the economy moving."

LaVorgna noted economists' expectations for continuing economic recovery in the second half of 2020, pointing to the Atlanta Federal Reserve's GDPNow estimate of third quarter growth near 30%. Meanwhile, private sector forecasts for 2021 are "looking for GDP upwards of 6%," said LaVorgna, former chief economist of the Americas at Natixis and chief U.S. economist at Deutsche Bank.

"This means that the revenues are going to come back, the economy's going to look a lot healthier, we're going to grow that GDP portion, and those deficits are going to come down," LaVorgna said. "So the point is getting the economy back to work, getting the jobs that are coming back to continue getting strong wage gains. Those are all the things the president is focused on. If you're looking at deficits, that's really right now the totally wrong metric."

The U.S. economy added 1.4 million jobs in August, and the unemployment rate plummeted 1.8 percentage points to 8.4%. This represents the second largest monthly decline in unemployment since the series began in 1948, trailing only the 2.2 percentage point drop in June 2020. And, for the first time since the pandemic peak in April, the unemployment rate has fallen below the Great Recession peak of 10%.

The time for prioritizing the deficit metric is "when the unemployment rate is back down to where it was considered to be a very low level, which is getting there much sooner than people think," LaVorgna said. "But now isn't the time. The market will tell us that. When you start to see the market worried about inflation pressure, and worried about being able to finance large deficits, then we'll worry about that. But that is a long time away. Instead, what we should focus on is getting the economy back, keeping it on this very powerful track."