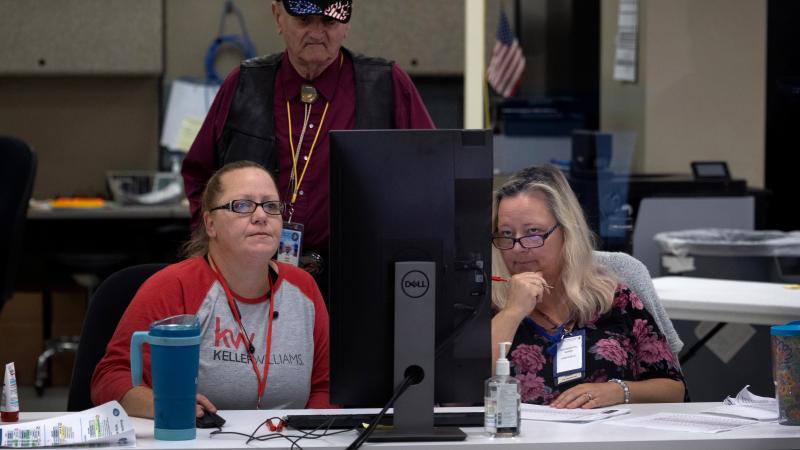

Millions in forgivable COVID relief loans meant for small business diverted to unions: report

Teachers' unions and unions for state and local government employees across the country received funding, even though they were not affected by the sorts of economic shocks private businesses were.

The federal Payment Protection Program established in 2020 to help small businesses and protect the jobs of their workers eventually was allowed to include unions, and millions in forgivable loans ended up with them and other organizations.

Eligibility and timing are in question for many, according to a new report from the Freedom Foundation. Nationally, labor organizations received $36.7 million in PPP funds, and $1.2 million ended up in the hands of Pennsylvania unions.

"Disconcertingly, the apparently inappropriate PPP loans may have been granted due to fraudulent loan applications or other questionable conduct by applicants or the private lenders operating under the SBA's delegated authority," wrote Maxford Nelsen, report author and director of labor policy at the Freedom Foundation.

PPP eligibility expanded from small businesses and nonprofits in March 2020 to include labor unions and building corporations by March 2021. But many unions applied for funding before they could legitimately receive the largesse.

Teachers' unions and unions for state and local government employees across the country received funding, even though they were not affected by the sorts of economic shocks private businesses were.

"This was a complete breakdown in how the program was supposed to work," Nelsen said.

As most unions did not qualify for PPP loans before legislation signed into law on March 11, 2021, it wasn't a matter of misfiled paperwork. They did not qualify for program funds at all in the time period when they applied. As the paperwork went through private lenders and not the Small Business Administration, applications are not publicly available. Thus, it's unclear whether private lenders failed in understanding program qualifications or if unions misrepresented how the funds would be used.

"It's become pretty clear in the year since the program was launched that the SBA did not have proper controls in place to ensure that the funds were only going to eligible recipients," Nelsen said.

"Loans determined through the loan review process to have been made to ineligible borrowers will not be forgiven," SBA Administrator Jovita Carranza wrote after a critical investigator general report.

Yet the Freedom Foundation noted that $24.2 million of the $36.7 million in union loans have already been forgiven.