Ticking retirement timebomb? Unfunded state pension liabilities grow to $8.28 trillion

Liabilities are nearly $25,000 for every person in the United States, according to a new report from American Legislative Exchange Council. The American Legislative Exchange Council released the latest edition

Unfunded state pension liabilities have climbed to $8.28 trillion, or nearly $25,000 for every person in the United States, according to a new report from the American Legislative Exchange Council.

The American Legislative Exchange Council released the latest edition of its report on pensions in all 50 states Thursday. The report, "Unaccountable and Unaffordable 2021," shows just a handful of states with outsize pension liabilities account for a large share of overall pension debt in the U.S.

The report looked at 290 state-administered government pension plans and their assets and liabilities from fiscal year 2012 to fiscal year 2020. An example of state-administered government pension plans in Illinois would cover state employees, teachers, university workers, judges and lawmakers.

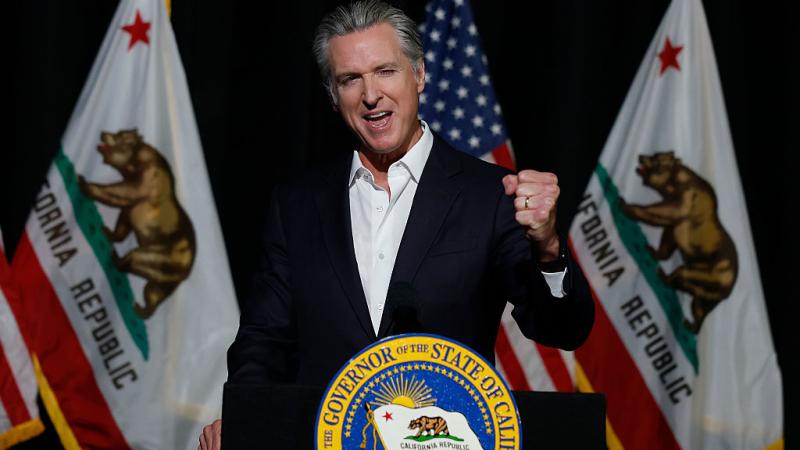

The states with the most unfunded liabilities were California ($1.53 trillion), Illinois ($533.72 billion), Texas ($529.70 billion), New York ($508.70 billion) and Ohio ($429.53 billion). These five states alone account for more than $3.5 trillion in unfunded liabilities, or about 43% of all unfunded liabilities in the U.S.

The bottom 10 states make up $4.9 trillion, or 59.36% of all unfunded liabilities, according to the ALEC report. On a per capita basis, the bottom five state were Alaska ($42,829), Illinois ($41,656.79), Connecticut ($40,427.58), Hawaii ($39,939.43), New Jersey ($39,849.02) and California ($38,713.16).

"As state pension plans invest their funds in increasingly risky assets, the gap between expected rates of return and actual rates of return widens, with results falling far short of expectations," the authors of the report wrote. "When investment returns fail to meet expectations, taxpayers and plan members must make up the difference through increased contributions."

The states with the least unfunded pension liabilities were Vermont ($14.43 billion), South Dakota ($14.44 billion), North Dakota ($15.13 billion), Delaware ($18.46 billion) and Wyoming ($18.71 billion). On a per capita basis, the lowest were Tennessee ($8,511.92), Indiana ($10,188.66), Nebraska ($13,370.44), Florida ($14,062.16) and Idaho ($15,918.74).

No state in the U.S. has fully funded its pension plans. The state with the highest funding ratio in the nation is Wisconsin at 56% and New Jersey was the lowest at 18%.

"Many experts feared dramatic pension investment losses in 2020," the authors wrote. "Even in years where investment returns beat the assumed return, public pensions cannot invest their way out of the problem of growing unfunded liabilities. ... The problems of pension underfunding are structural. Poor assumptions, over promising benefits, chasing returns, and political investment strategies plague public pensions across the country."

The authors call for pension changes across the country. They further noted that those efforts should be while states are still flush with cash from federal COVID-19 programs.

Jonathan Williams, the chief economist and executive vice president of policy for the American Legislative Exchange Council, said the first step states need to take to change course is to stop making the problem worse.

"When you are in the hole, the first step is to stop digging it deeper," he said. "Right now, states are in a historically strong position when it comes to cash flow. There's a lot of money sloshing around state capitals right now. One of the things that can be done with the revenue growth from the state level is to pay down current unfunded liabilities."

States also need to examine the structure of their pension plans and switch from defined benefit plans to 401(K)-style defined contribution plans, Williams said.

"Many of the success stories in the states where we've seen states really improve on their unfunded liabilities is by transitioning new hires to more of a hybrid or cash balance or defined contribution type of approach," he said.

The report singled out the structural pension issues in Illinois.

"In some of the worst cases, states ignore the [actuarially determined contribution] and instead use state statute to contribute less than the ADC each year," the authors wrote. "Such is the case with Illinois. ... Illinois uses state statute to contribute less than its ADC payment, leading to the massive growth of unfunded liabilities. This practice did not change in FY 2019 or FY 2020."

Illinois spends about 25% of its annual general fund budget on pensions, but has failed to make a significant dent in its overall pension burden. The state's pension protection clause prohibits any diminishment of the pension benefits promised to state workers, which makes reforming the system a challenge, Williams said. The pension protection clause has hampered past efforts to make changes to Illinois' state-run pension systems.

"Without a constitutional change or a new interpretation by the Illinois Supreme Court, the only other option is a federal bailout," he said. "The status quo will continue without a radical change in leadership."

For states with large pension debts, such as Illinois and California, Williams said getting out of debt will take a long time. "The numbers are daunting, but it can be done," he said.