Biden admin excludes private loans from student debt forgiveness

The Federal Family Education Loan (FFEL) program used private banks to issue loans that the government guaranteed.

The Biden administration on Thursday updated its student debt forgiveness plan to exclude borrowers with privately held loans, potentially removing 4 million people from eligibility for debt relief.

Guidance from the Department of Education discussing eligible loan recipients stipulates that the government must currently hold the loan for an individual to be eligible for debt relief. "[C]onsolidation loans comprised of any [Federal Family Education Loan] or Perkins loans not held by ED are also eligible, as long as the borrower applied for consolidation before Sept. 29, 2022."

The Federal Family Education Loan (FFEL) program used private banks to issue loans that the government guaranteed, according to The Hill. It stopped issuing loans in 2010 and roughly 4 million people have privately held loans through the FFEL that are not currently eligible for relief.

The DoE insisted it was working with private banks to find a way to make FFEL loan recipients eligible. The DoE is "assessing whether there are alternative pathways to provide relief to borrowers with federal student loans not held by ED, including FFEL Program loans and Perkins Loans, and is discussing this with private lenders," it said, per The Hill.

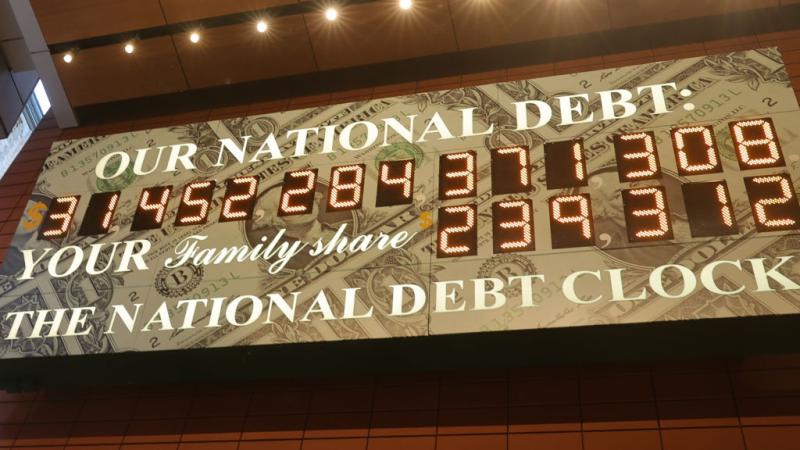

In late August, President Joe Biden announced a plan to forgive up to $10,000 in student loan debt for individual borrowers and up to $20,000 for Pell Grant recipients. The Congressional Budget Office has estimated that the plan will cost taxpayers $400 billion and the effort has attracted criticism from conservatives who argue that student debt relief would force the country's lower-income earners to shoulder the financial burdens of those with the highest earning potential.

Moreover, six Republican states on Thursday announced a suit against the administration to stop the debt cancellation altogether.

"No statute permits President Biden to unilaterally relieve millions of individuals from their obligation to pay loans they voluntarily assumed," they asserted in the suit. "Just months ago, the Supreme Court warned federal agencies against 'asserting highly consequential power beyond what Congress could reasonably be understood to have granted' by statute."