California likely next step in federal fraud probes after newest revelations in benefit programs

Fake student applications, Medicaid for illegal immigrants, and profligate food programs could make California the next target for federal scrutiny over allegations of benefit fraud.

From fake student applications seeking aid to unapproved Medicaid benefits for illegal immigrants, California is shaping up to be the next battleground for entitlement fraud after mushrooming Minnesota scandals reminded Americans how much of their tax dollars get misused. Even Democrats like California's Rep. Ro Khanna are concerned the Golden State may have provided a golden opportunity for fraudsters.

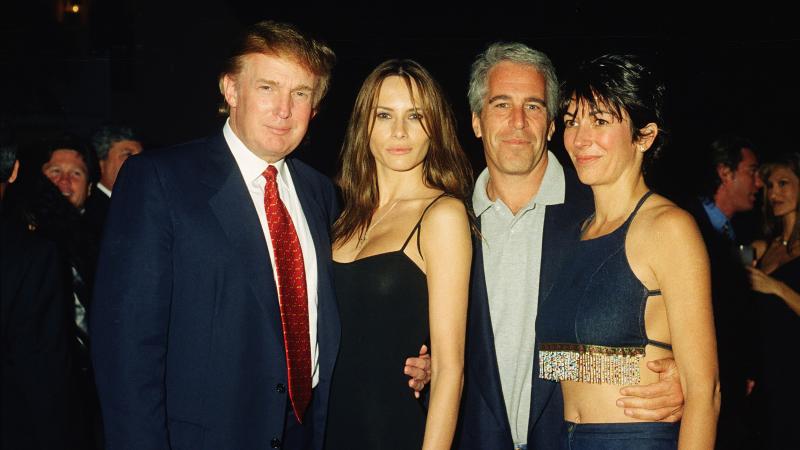

President Donald Trump says the confirmed and alleged fraud in Minnesota, which was targeted at the state’s food assistance program, daycare facilities, and medical programs is small “peanuts” compared to the fraud in other states.

“California is worse, Illinois is worse and, sadly, New York is worse — a lot of other places,” Trump said during a New Year’s Eve event. “So, we’re going to get to the bottom of this.”

Tackling state-level fraud a bi-partisan matter

The suggestion that there is fraud in California’s social programs seems to have drawn bipartisan agreement. Khanna, who represents the Silicon Valley in the San Francisco Bay Area, has embraced efforts to tackle state-level fraud to build support for a new wealth tax and ensure its revenues are not wasted.

“If you want, as I do, to advocate for Medicare for all, to advocate for higher taxes, you have to have the public trust,” Khanna said in an interview with CNBC. “People need to have a receipt for what their money is going toward. You can’t have corruption in the government and waste in the government and then expect people to support the progressive ideals that I have.”

Khanna’s proposal, which he said would involve a bipartisan partnership with the House Oversight Committee to investigate state-level fraud, came after a recent report from the California State Auditor earlier this month which designated the state’s Department of Social Services a “high risk” to the financial health of the state as a result of its elevated nutrition assistance program’s high payment error rate.

The problem, according to the auditor, is the state’s CalFresh program, which administers federal Supplemental Nutrition Assistance Program (SNAP) funds. Due to changes in the One Big Beautiful Bill that President Donald Trump signed into law earlier this year, the federal government is no longer guaranteed to cover the whole cost of state programs.

States on the hook for excessive payments made in error

Instead, if states have a payment error rate above a certain threshold, the state is required to contribute anywhere from 5% to 15% of the total program cost with its own funding source. The payment error rate is the rate of over or underpayments of benefits. While California’s payment error rate of about 10% is in line with the national average, it lies above the 6% threshold imposed by the OBBB.

“Because the recent federal changes to SNAP will require California to shoulder part of the cost of the program’s benefits, CalFresh is now a high‑risk program. If the State does not decrease its [payment error rate], it will likely need to spend about $2 billion annually to maintain CalFresh benefits,” the state auditor warned.

“This is particularly concerning considering that California faces growing multiyear budget deficits, as well as a $20 billion operating deficit for SFY 2026–27. The addition of these significant, new state costs will jeopardize a key program for Californians in need and pose a serious impediment to balancing the State’s budget,” the report concluded.

Some states resisting cooperation to fight fraud

The Trump administration believes there is “massive fraud” within the SNAP and other federal benefits programs. Earlier this year, Agricultural Secretary Brooke Rollins requested that states turn over SNAP program data, but a coalition of states sued the administration to block access. California, the state with the greatest number of SNAP recipients at 5.3 million, led the lawsuit. In the data turned over by cooperating states, Rollins said the administration had already uncovered fraud.

One avenue of potential fraud is the growing number of apparent liquor stores and smoke shops that are approved as retailers under the program, which was designed to improve Americans’ nutrition during the Great Depression. According to the Foundation for Government Accountability, which shared the data with Just the News, nearly half of all the liquor and smoke shops it identified in the USDA database were located in California.

In addition to its food programs, California’s community college system has been the subject of growing financial aid fraud in recent years. According to the Los Angeles Times, more than 1.2 million fake students applied to community colleges across the state in 2024 alone.

Because every student that applies to the state schools is admitted, and there are more options for remote and hybrid classes since the COVID-19 pandemic, scammers use the fake profiles to cash in on both federal and state financial aid. According to the Times, the scammers–often running multiple student profiles at once–stay enrolled in classes long enough to collect aid for books, housing, food or other needs and use it for other expenses, like vacations and designer items.

Though the California Community Colleges system captures many of the fraudulent student profiles, data from the chancellor’s office show about $8.4 million in federal and $2.7 million in state aid were stolen in 2024, the Times reported.

In June, the Department of Education implemented new identity verification requirements after California Congressman Kevin Kiley sent a letter warning about the fraud in his state. Part of the changes include a new requirement for an applicant to present an unexpired, valid government ID. The department specifically cited the growth in aid fraud at California’s community colleges for its decision.

Inspector General: "California improperly claimed $52.7 million in Federal Medicaid"

Additionally, the federal Health Department has raised concerns about potential fraud in California’s Medicaid system. The Health and Human Services Department Inspector General determined earlier this year that the state improperly claimed $52.7 million in federal Medicaid reimbursement for payments made on behalf of illegal immigrants.

States are generally prohibited from using any federal money to cover care for such individuals and would normally have to pay out of their own state budgets if they provide care to illegal immigrants, the inspector general said in its May report.

“California improperly claimed $52.7 million in Federal Medicaid reimbursement because it continued to use the proxy percentage that was developed in the early 2000s without assessing whether the percentage correctly accounted for the costs of providing nonemergency services to noncitizens with [Unsatisfactory Immigration Status] under managed care. In addition, California did not have any policies and procedures for assessing and periodically reassessing the proxy percentage,” the inspector general wrote.

But this is only a part of the Medicaid story. There are also concerns that California is using a loophole in the law to funnel billions of federal dollars into paying for healthcare for illegal immigrants, according to a report released earlier this year by the Paragon Health Institute and the Economic Policy and Innovation Center.

According to the report, California “taxes Medicaid insurers and then makes higher payments to those same insurers with that tax revenue. The higher payments enable the state to claim additional federal matching dollars.” These surplus funds are then available to the state to use elsewhere, like expanding Medicaid services for illegal immigrants.

"The state of California, colluding with insurance companies who cover Medicaid beneficiaries, has created one of the most outrageous ones yet, a money laundering scheme that results in California obtaining more than $19 billion in federal money without any state contribution over the period from April 2023 through December 2026,” President of EPIC Paul Winfree told Fox News earlier this year.

The Facts Inside Our Reporter's Notebook

Links

- food assistance program

- daycare facilities

- medical programs

- Trump said

- Khanna said in an interview with CNBC

- payment error rate of about 10%

- the state auditor warned

- requested that states turn over SNAP program data

- had already uncovered fraud

- growing number of apparent liquor stores and smoke shops

- more than 1.2 million fake students

- use it for other expenses

- about $8.4 million in federal and $2.7 million in state aid were stolen

- implemented new identity verification requirements

- sent a letter warning

- the inspector general said in its May report

- to funnel billions of federal dollars into paying for healthcare for illegal immigrants

- the report

- told Fox News earlier this year