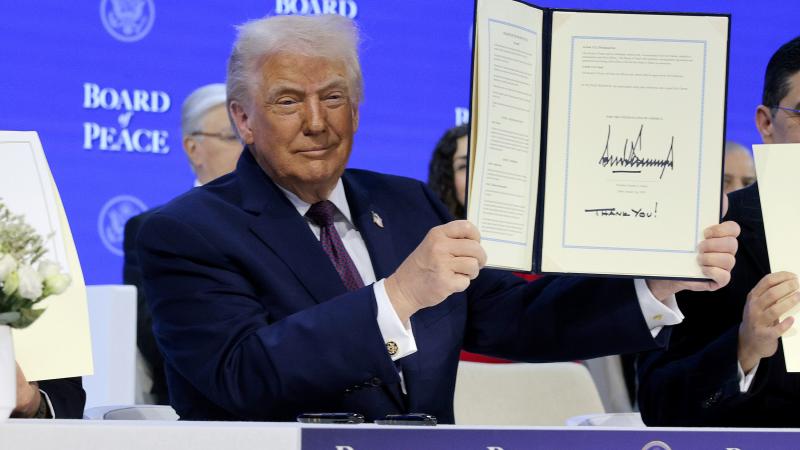

Bipartisan tax bill that could cost $1.5 trillion over 10 years up for House vote on Wednesday

House Speaker Mike Johnson reportedly committed to holding a separate vote on raising the SALT deduction to $20,000 as a way to get moderate Republicans on board with the tax package ahead of the planned vote

The bipartisan tax bill that the Tax Foundation estimated could cost $1.5 trillion over 10 years is up for a House vote on Wednesday.

House Speaker Mike Johnson reportedly committed to holding a separate vote on raising the State and Local Tax (SALT) Deduction to $20,000 as a way to get moderate Republicans on board with the tax package ahead of the planned vote.

Conservative House members still have concerns about the bill on the day of the scheduled vote, Just the News has learned. The conservative criticism of the package includes the lack of a provision that prevents illegal immigrants from claiming the Child Tax Credit on the tax returns they file using taxpayer identification numbers in lieu of Social Security numbers.

The tax package expands the CTC from $2,000 per child to $3,600.

The $80 billion score that lawmakers used to assess the bill at the committee level is only the cost through 2025.

"It would cost between $700 billion and $1.5 trillion over ten years to make the tax deal permanent, depending on how much of the underlying current law child tax credit (CTC) we include in a permanency package," said Garrett Watson, a senior policy analyst at the Tax Foundation. "That’s much more than the gross cost of the temporary provisions being considered now (which is about $80 billion) and would require additional offsets if we want to avoid raising the deficit."