House Dems to release tax-increase package, 'biggest in decades,' to offset $3.5T spending bill

Proposal reportedly would raise corporate rate to 26.5%, increase the top tax rate for individuals to 39.6%.

House Democrats on Monday released an individual and corporate tax-increase plan that collectively appears to be the biggest in decades to cover their party's proposed $3.5 trillion spending package.

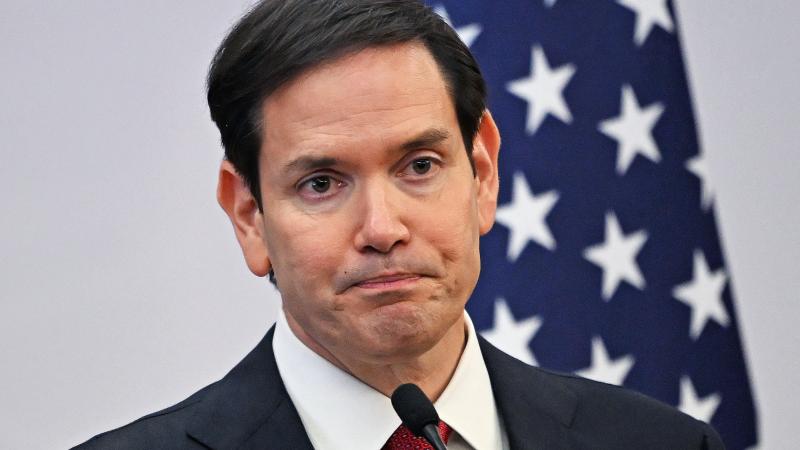

The conference, led by Ways and Means Committee Chairman Rep. Richard Neal, wants to raise the corporate rate to 26.5% as part of nearly $3 trillion in tax increases to defray the cost of the spending package, which include such progressive initiatives as expanding government-backed health care and green energy programs.

Neil also wants to increase the top tax rate for individuals to 39.6%, according to Politico.

The proposal could also reportedly include a new, 3% surtax on Americans making over $5 million and raising the top capital gains rate from 23.8 to 28.8%.

Neal also wants to raise taxes on multinational corporations’ overseas profits, tighten estate tax rules and pare back deductions for some unincorporated businesses, Politico also reports.

The Massachusetts Democrat, now Congress's chief tax policy writer, also reportedly wants new limits on “supersized” individual retirement accounts, additional restrictions on deductions companies take for highly compensated employees and new rules for people who own cryptocurrencies.

The proposals collectively would be the biggest tax increase in decades, Politico says.

Democrats control the House but only by a narrow majority, which will make passage difficult, considering the conference’s more moderate will likely raise concerns about agreeing to such a big increase with reelection now about 13 months away.

Senate Democrats are expected to pass the estimated $3.5 trillion spending measure through a parliamentary maneuver known as "budget reconciliation."

However, they will need all 50 members to vote yes, with West Virginia Sen. Joe Manchin, a moderate, effectively saying he cannot support the measure with that price tag.