House Judiciary Committee subpoenas investment firms Vanguard and Arjuna Capital in antitrust probe

Both firms have provided thousands of pages of documents to the House committee, but Jordan said their overall responses have been "inadequate."

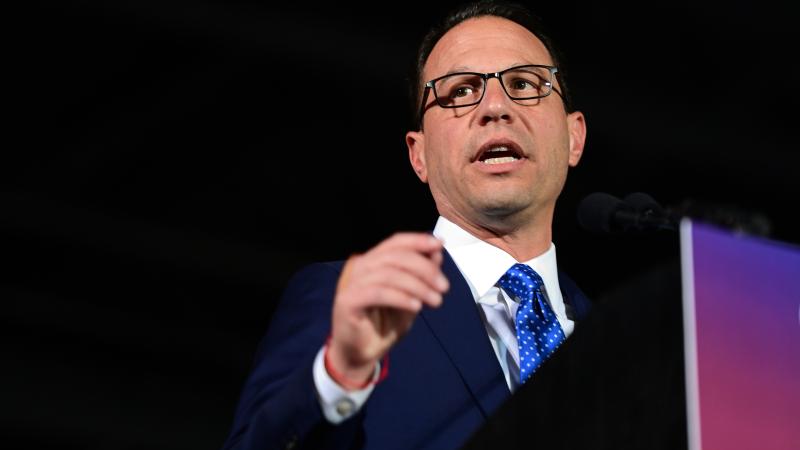

House Judiciary Committee Chairman Jim Jordan on Monday subpoenaed asset management firms Vanguard and Arjuna Capital as part of his committee's investigation into antitrust laws.

While corporations adopt environmental, social and governance-related goals, Vanguard, the world's second-largest asset manager, "appears to have entered into collusive agreements to 'decarbonize' its assets under management and reduce emissions to net zero in ways that may violate U.S. antitrust law," Jordan wrote to Vanguard in a letter with the subpoena.

In a letter to Arjuna Capital, Jordan voiced similar concerns that the company's support of environmental, social and governance-related efforts, known as ESG, as well as its decarbonization agreements could violate U.S. antitrust law.

"Contrary to your representation to the Committee, the documents that Arjuna has produced suggest that Arjuna may have artificially limited its collection of responsive documents," Jordan also wrote in the letter to Arjuna Capital.

Both firms have provided thousands of pages of documents to the House committee, but Jordan said their overall responses have been "inadequate," especially when considering their sizes.

The investment firms are not the first to be subpoenaed in Jordan's antitrust investigation related to ESG policies. In June, Jordan issued a subpoena of climate advocacy firm Ceres on the matter. The investigation expanded in July to include asset managers.