'Fast money equals fast crime': Fraud recovery sleuths share lessons of stolen COVID relief funds

Small Business Administration, state unemployment systems simply "weren't ready to vet" applicants fully, said National Pandemic Fraud Recovery Coordinator Roy Dotson.

Fraud recovery experts at the FBI and Secret Service detailed the challenges facing law enforcement in recouping tens of billions of dollars in stolen taxpayer funds since the federal government began disbursing record sums in record time for emergency pandemic relief in March 2020.

"I've never seen anything of this magnitude," said National Pandemic Fraud Recovery Coordinator Roy Dotson, who has 30 years experience in law enforcement, during a discussion on combating fraud organized by the Bethesda Chapter of AFCEA. "It was an online application so pretty simple. You could look up whatever information you wanted or use other people's identification, PII [Personal Identifiable Information], and put that in, and the money just flowed to whatever accounts you wanted it to."

The lesson? "I've learned that fast money equals fast crime," said Dotson.

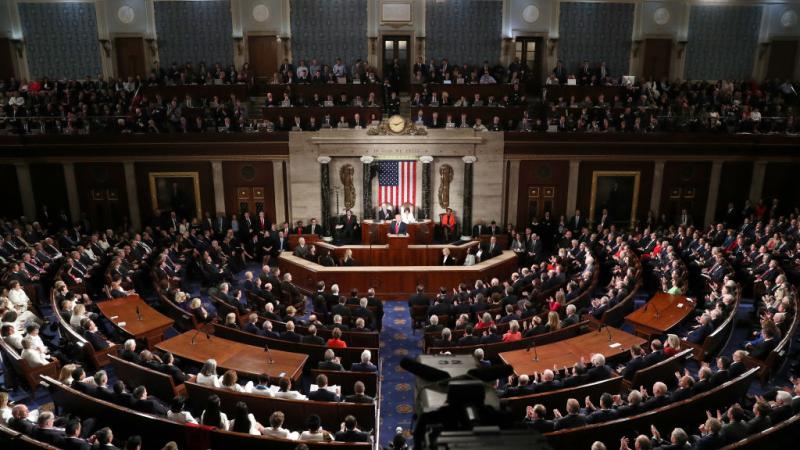

The unprecedented amount of money that Congress has spent on stimulus programs has attracted domestic and international fraudsters looking to game the system.

"Congress wanted to do the right thing helping out those that were hurting from COVID-19 and wanted to get that money to them quickly, whether that was, unemployment or a Small Business Administration [Paycheck Protection Program] loan," said Dotson, who works at the Secret Service, in an interview after the discussion.

"With that said, the system has never had to put out this kind of money," he told Just the News. "You know, Department of Labor, SBA, they're small agencies, they really are. And their systems just weren't ready to vet them properly."

The Department of Labor worked in conjunction with state unemployment systems to issue a federal jobless benefit bonus on top of state benefits during the pandemic. Fraudulent claims paid out have exceeded $86 billion, according to some estimates. A separate study put PPP fraud at about $76 billion.

In terms of the PPP loans, many individuals have been charged with falsifying documents to obtain loans that were forgivable if used for qualifying expenses. The SBA's partner lenders received fees on each forgivable loan they approved.

In one case, Robert Benlevi of Encino "submitted 27 PPP loan applications to four banks between April and June 2020 on behalf of eight companies," according to the Department of Justice. "In the applications, Benlevi sought a total of $27 million in forgivable PPP loans guaranteed by the Small Business Administration (SBA) under the Coronavirus Aid, Relief, and Economic Security (CARES) Act. In his fraudulent applications, Benlevi represented that each of his companies had 100 employees and average monthly payroll of $400,000, even though he knew that the companies did not have any employees or payroll expenses."

Dotson was asked if he thinks the fee incentives led to some lenders approving loans quickly without doing proper vetting.

"I'm sure at some level in wanting to get those funds out to people that they believed were in dire need ... those systems were probably expedited in some way," he said. "Whether that could have been prevented or not, you know, again, we could all talk through things we've learned. I'm sure that we would all do things differently next time."

Dotson elaborated on the process federal authorities go through to reclaim property purchased with stolen PPP funds.

"If we investigate a case and we determine that fraud occurred, and there was proceeds from that fraud used to purchase some asset ... we're going to try to recoup those, whether it's a vehicle, could be a residence, could be a boat, we're going to recoup those and seize those and hopefully forfeit them," he explained. "And then there is a process to convert that and then return the funds to the victim, whether that's the U.S. government or a state."

In December 2021, the Department of Justice estimated that federal law enforcement recouped about $2.2 billion of more than $100 billion in fraudulently obtained funds.

Dotson was asked for an updated amount that federal authorities have been able to recoup so far from fraudulently obtained loans or jobless payments.

He said those figures are "being more fine-tuned right now" and more accurate numbers will be put out soon.

"We have over 900 ongoing cases at this time that we can't talk about," Dotson said.

Steven M. D'Antuono, head of the FBI's Washington Field Office, was asked if he foresaw the unprecedented amount of fraud coming when he viewed the original PPP loan application, which essentially asked applicants to attest to the accuracy of the information they were providing about their business and how many employees they were paying rather than provide solid evidence.

"I think the lenders, everyone, was trying to do what they were supposed to be doing," he said. "Like the mortgage industry back in the day, right, everyone was trying to get mortgages, trying to build houses up, getting the economy going, and people take advantage of that."

D'Antuono said that it is preferable to find ways to prevent fraudsters from obtaining taxpayer funds in the first place rather than chase after the money later.

"We're trying to squirrel back as much money as we possibly can when we get these people, but as was described, a lot of times people are spending the money, right, spending on a Lamborghini or on a house or on a yacht or whatever ... siphoning off the money," he explained. "So it's trying to squirrel that stuff back and actually get dollar for dollar on that stuff because it's going to be difficult."

D'Antuono said the American public has to give law enforcement time to recoup the stolen pandemic funds, explaining the FBI's work is not like a "CSI" television show.

"These things are not going to happen in 45 minutes during commercial breaks," he said. "It's just not. You've got to give law enforcement time, right? We're not miracle workers on a lot of this stuff. We're very, very good at what we do, but it's not a TV show, and the systems that we have are the systems. It's not going to be like what you see on TV."

Smartphones, for example, are highly sought-after pieces of evidence during investigations, D'Antuono explained, but it could take law enforcement between six weeks to six years to gain access to them in certain cases.

He said the "CSI effect" makes the general public think law enforcement can obtain fingerprints, DNA and digital devices immediately.

"Take a step back, take a step off of the lounger or the couch, and look at it from a realistic standpoint," he said. "Trust what law enforcement is telling you, and I know for some people that's difficult."