After teleworkers' belated return to workplace, IRS pockets $80B windfall, eyes 87,000 new hires

IRS leadership didn't return to the office until April 24, and even then were only required to work in the office once per pay period.

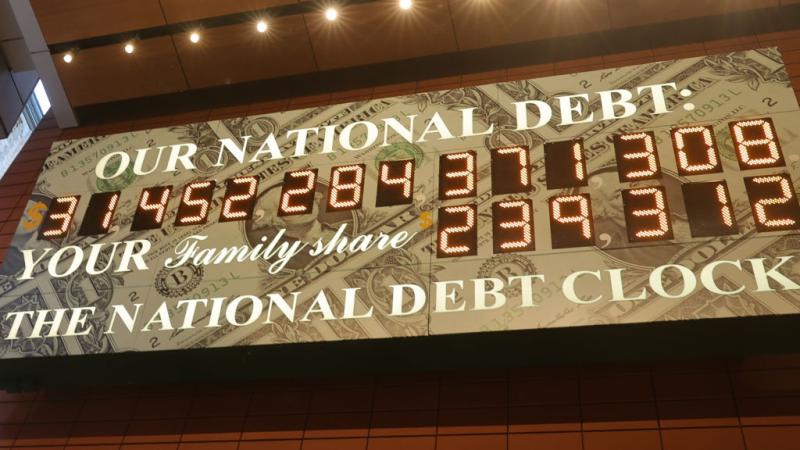

Flush with an $80 billion funding windfall from the Democrats' recently enacted $740 billion tax and spending bill, the IRS plans to massively expand its workforce with up to 87,000 new employees — but the agency showed little sense of urgency about bringing its current employees back to the office after the COVID-19 pandemic.

It wasn't until late June that IRS employees were all finally required to return to the workplace, and many continue to enjoy flexible work schedules.

As of April, when the agency began its return-to-work program for teleworkers, 53% of IRS employees were teleworking full-time. IRS leaders didn't return to the office until April 24, and even then they were required to work in the office only once per pay period. In-person operations for all employees resumed June 25, but employees were still given the option to telework at least some of the time.

The revenue collection agency, which has been stockpiling ammunition, received an $80 billion funding boost in the Democrats' recently enacted tax and spending bill, dubbed the Inflation Reduction Act, and plans to hire nearly 87,000 new employees over the next decade.

Prior to the COVID-19 pandemic, about half of the IRS' 78,000 employees were eligible for telework, and about one-third of agency employees teleworked at least once per week between October 2019 and early March 2020.

After a year of working at the IRS, employees can plan their work days around their own schedule, according to an employee resource page at the agency website (IRS Careers alternate schedules/leave). Four different options are offered that employees may choose from to organize their work schedule.

Meanwhile, an IRS job posting for a Criminal Investigation Special Agent listed as one of the duties of the position: "Carry a firearm and be willing to use deadly force, if necessary." The agency has stockpiled more than 5 million rounds of ammunition, which led Rep. Matt Gaetz (R-Fla.) to introduce a bill in July that would ban the agency from purchasing ammunition.

Of the $80 billion the IRS receives in the Democrats new $740 billion tax and spending law, $45.6 billion is to be used for enforcement activities, such as "to determine and collect owed taxes, to provide legal and litigation support, to conduct criminal investigations (including investigative technology), to provide digital asset monitoring and compliance activities."

Taxpayer assistance, filing and account services will receive only $3.2 billion from the recent funding windfall.

In response to a request for comment, the IRS sent Just the News a statement from August regarding the signing of the Inflation Reduction Act.

The statement, in part, reads, "The IRS has struggled for many years with insufficient resources to fulfill our important mission. During the next 10 years, these funds will help us in many areas, including adding critical resources to not just close the tax gap but meaningfully improve taxpayer service and technology. This will allow the IRS to provide services to taxpayers in the manner they expect and deserve. The act also includes a wide range of tax law changes that we will have to implement very quickly."