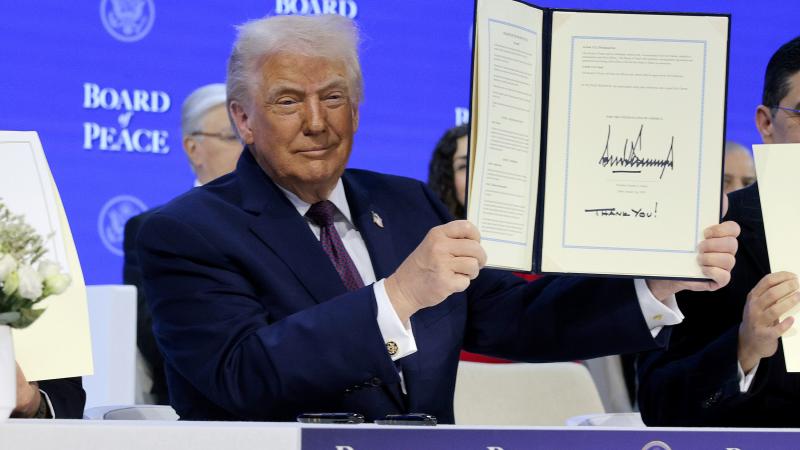

Trump defies odds, achieves economic triple play with rate cuts, tariffs and cooling inflation

Trump is defying the dire warnings of economists and the left—who insisted that rate cuts plus tariffs would make cooling inflation impossible—by delivering exactly that trifecta right now.

Contrary to conventional economic wisdom and warnings from critics on the left and many economists that cutting interest rates while imposing broad tariffs would inevitably stoke inflation, the Trump administration is achieving all three simultaneously – with the Federal Reserve lowering rates, significant tariffs in place and inflation cooling to 2.7% as of late 2025.

"Democrats and economists were caught with egg on their face when President Trump's policies delivered historic job, wage and economic growth in his first term – along with the first reduction in wealth and income inequality in decades. As the Trump administration's policies continue taking effect, these same Democrats and economists are set to be proven wrong, again," White House spokesman Kush Desai said exclusively to Just The News.

Despite widespread predictions from economists and opponents that combining rate cuts with tariffs would prevent inflation from cooling, recent data shows the Federal Reserve reducing rates amid Trump's tariff regime while inflation has eased.

The Consumer Price Index report for November 2025, released this morning by the Bureau of Labor Statistics, showed headline inflation cooling to an annual rate of 2.7%, down from 3.0% in September and below economists' consensus expectation of 3.1%.

Core inflation, excluding volatile food and energy prices, came in even lower at 2.6% –the slowest pace since early 2021 –providing a positive signal amid Trump's second term. This better-than-expected moderation reflects ongoing efforts to stabilize the economy following higher inflation trends earlier in the year.

The CPI report carries caveats due to a prolonged government shutdown that disrupted October data collection entirely and delayed November's, resulting in no standard month-to-month comparisons.

The tariff naysayers were unified around one general message: Imposing tariffs would undoubtedly fuel inflation.

However, another school of thought that the president and his economic advisers likely recognized and leaned into is the notion that there's a key offset ignored by those conventional economic soothsayers. That is, that tariffs usually reduce how much the country imports. To pay for imports, a country needs to sell exports. If imports go down, exports typically go down too, since the two are closely linked in the economy.

When exports fall, the goods that used to be exported now stay at home. These are things the country is especially good at producing efficiently. With more of them available domestically (instead of being shipped out), their prices inside the country tend to drop due to extra supply.

Economist and originator of the famed Laffer curve, Art Laffer, spoke exclusively to Just The News and stated it this way: "Tariffs do not raise overall prices simply because the increase in the domestic prices of imports (products more efficiently produced abroad) are offset by the fall in domestic prices of formerly exported products (more efficiently produced domestically.)"

The pushback Trump received while enacting his agenda may have been driven by the desires of his political foes and others with differing economic policy ideas. Trump repeatedly criticized Federal Reserve Chairman Jerome Powell for his refusal to lower interest rates. John McLaughlin, pollster and strategic consultant, spoke to this deep-seated opposition and told Just The News,

"The worst part is the ruthless Democrats, like [Democratic Senate leader] Chuck Schumer and [Democratic House leader] Hakeem Jeffries, are doing everything they can to continue to allow Americans to suffer. They knew that shutting down the government slows the GDP, slows the economic growth of the country."

"When we polled in October, 59% of all Americans wanted Jerome Powell to be fired – 59% to 24%. Fire them so interest rates could come down. They know who the Fed chairman is. The independent bankers and the Fed are keeping interest rates higher than the rate of inflation to hurt the economy. The elitists in Washington want to basically hurt Donald Trump so that they can win the house."