Household debt jumped $2 trillion over course of pandemic, now stands at $16 trillion

Spike was driven by mortgages, credit card balances

Households in the United States have added roughly $2 trillion worth of debt over the course of the COVID-19 pandemic, with total debt in U.S. households coming within shouting distance of $20 trillion, according to industry data.

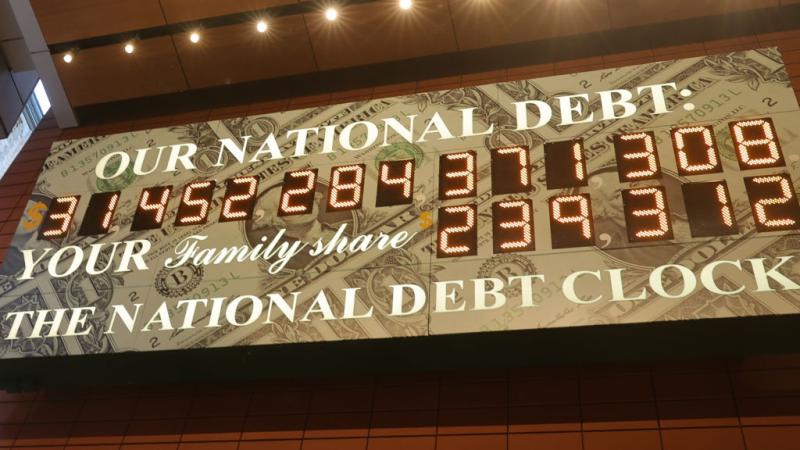

The New York Federal Reserve said in a report this week that the U.S. saw "an increase in total household debt in the second quarter of 2022, increasing by $312 billion (2%) to $16.15 trillion."

"Balances now stand $2 trillion higher than at the end of 2019, before the COVID-19 pandemic," the report said.

That spike was driven in large part by mortgage balances and credit card purchases, the Fed said, noting that "the 13% cumulative increase in credit card balances since Q2 2021 represents the largest in more than 20 years."

Regarding other debt sources, the report noted that "auto loan balances increased by a solid $33 billion in the second quarter, while student loan balances were roughly unchanged from the first quarter and stand at $1.59 trillion."

"In total, non-housing balances grew by $103 billion, the largest increase seen since 2016," the report said.

The data come at a time when most Americans are struggling to afford many basic necessities such as food and fuel, with skyrocketing inflation and gas prices taking huge chunks out of monthly budgets.