Senators request answers for billions to Iran, its terror proxies

The Department of Defense inspector general's warnings of potential corruption and fraud were said to have been neglected since 2012 until a private sector audit revealed the illicit activity, emphasizing why the oversight and lack of safeguards after those warnings should catalyze the need for lasting change.

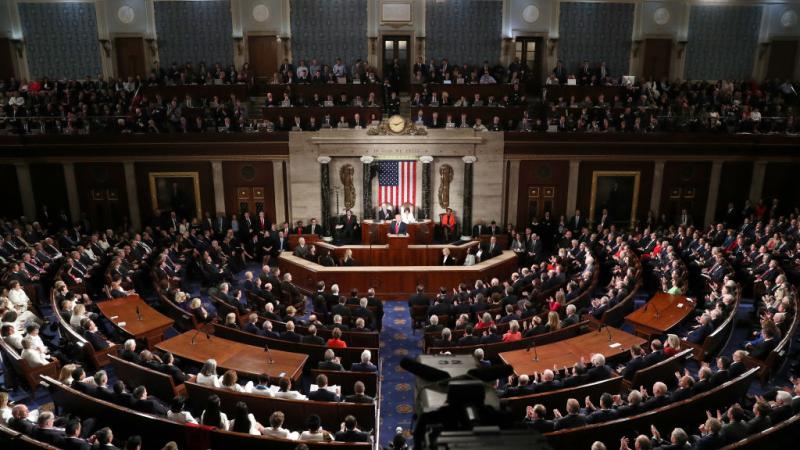

Two U.S. senators have joined together in a letter to the Federal Reserve Bank of New York and the Board of Governors for the Federal Reserve demanding answers after a new report outlined the agency's failures in connection with the Central Bank of Iraq.

The result was billions directed to Iran and its terror proxies.

Sen. Tim Scott, R-S.C., alongside fellow Senate Banking Committee member Sen. Mike Rounds, R-S.D., requested reponse by Oct. 30. The letter comes days before the Oct. 7 anniversary approaches of the attacks carried out by Hamas, Iran's terror proxy, on U.S. ally Israel.

The letter was issued after the Wall Street Journal published a piece on Ali Ghulam, known as the "undisputed dollar king of Iraq" for nearly a decade, and how his three Baghdad banks wired tens of billions of dollars outside the country throughout that time.

According to the report, "as much as 80% of the more than $250 million in dollar wire transfers flowing through them on some days were untraceable, and some portion of that amount went secretly to Iran's Islamic Revolutionary Guard Corps and the anti-U.S. militias it supports."

The report highlights the lack of implementing basic anti-money laundering controls on account relationships with the Central Bank of Iraq, saying the agencies play an instrumental part in both crafting and implementing Bank Secrecy Act and Anti-Money Laundering laws in the U.S. banking system.

"These transactions were facilitated without any disclosure of where the funds originated or the intended recipients – which if true, is astounding," the letter reads. "As you know, if these actions were carried out by a commercial bank, the bank and its executives would likely be subject to severe civil and criminal penalties, including permanent closure."

The Department of Defense inspector general's warnings of potential corruption and fraud were said to have been neglected since 2012 until a private sector audit revealed the illicit activity, emphasizing why the oversight and lack of safeguards after those warnings should catalyze the need for lasting change.

The senators are asking for any changes made to the Wall Street Journal's report, any communications with any U.S. government inspector general or other government officials, or any other concerns related to potential fraud or BSA/AML concerns involving U.S. dollar programs related to the Federal Bank of New York in Iraq from 2003 to 2024.

The findings and recommendations from the K2 audit provide an overview of the federal bank's AML policies and procedures related to Central Bank of Iraq transactions from 2003 to 2022.

Lastly, the letter asks if the federal bank has reexamined its AML controls involving other high-risk countries following the K2 audit.

Scott has continuously demanded answers after the Biden administration released $6 billion to Iran in August 2023, requesting Treasury Secretary Janet Yellen to testify on the matter.

The Revoke Iranian Funding Act was initiated following the Oct. 7 attack, and the reporting requirement in RIFA was signed into law in April.

Treasury Deputy Secretary Wally Adeyemo stated in his testimony to the Senate Banking Committee that for Iran, “any dollar they have will go towards their violent activity before they deal with their people.”