State energy bank discussions heat up

The state budget still contained language allocating funding to the bank – though Surovell questioned it, saying the funding was tied to the passage of the bill.

The Virginia Department of Energy has established a state energy bank despite the failure of a General Assembly bill creating the bank back in April, resurrecting claims of gubernatorial overreach among the governor’s detractors.

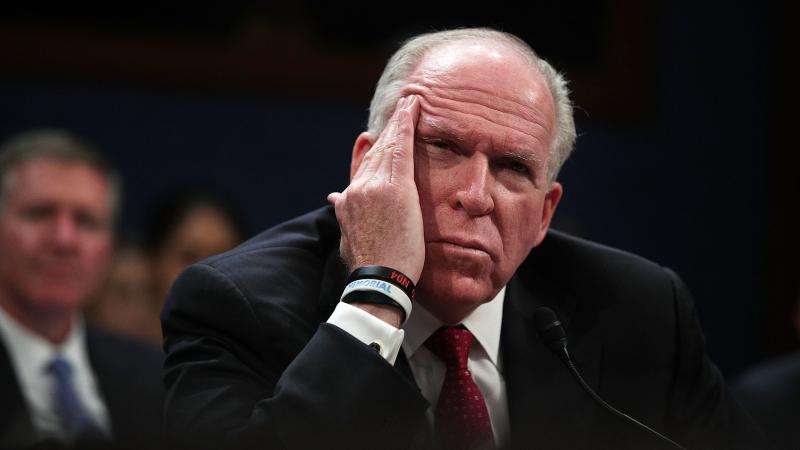

“It just seems like the administration thinks it can just create a bank out of its just sort of remedial powers of the governor,” said Senate Majority Leader Scott Surovell, D-Eastern Fairfax, after hearing a presentation on the bank from the department’s director, Glenn Davis.

Davis presented on the bank to the state Senate Finance and Appropriations Committee on Monday, including a brief overview of its origins.

About one year ago, “with the support of the governor,” according to Davis, Virginia Energy began working in earnest toward the creation of a bank that would help the state achieve its clean energy goals. Surovell and Del. Alfonso Lopez, D-Arlington, introduced legislation for the 2024 legislative session establishing such a bank, and though Surovell’s bill made it to the governor’s desk, Republican Gov. Glenn Youngkin vetoed it due to the “significant conflicts between the bank and the Department of Energy itself” within it, according to Davis.

The state budget still contained language allocating funding to the bank – though Surovell questioned it, saying the funding was tied to the passage of the bill.

“What legal authority does the administration have to transfer $10 million from central appropriations to your department if it’s not specifically authorized in the budget?” Surovell asked Davis.

Davis responded that the budget language facilitated funds for the bank without making reference to a bill.

“The language reads that ‘out of the amount in this item, $10 million the first year from the general fund shall be provided',” Davis said. “That budget language does not reference a bill. It references that it shall be stood up.”

Davis said the agency had the authority to set up the bank, as the department already “gives out” loans and the Virginia Clean Energy Innovation Bank’s scope is limited to its role.

“This is not the true definition of a bank," Davis said. "We’re not doing deposits, there’s no FDIC involved. A lot of the opportunities and responsibilities of a real bank… is not what we’re dealing with here. This is basically a bank in name only. We basically do what we’ve already done today.”

Surovell maintained the bank’s creation was “an incredible extension of government power,” and without going through the General Assembly, an inappropriate risk to Virginia taxpayers. The committee resolved to discuss it further on a later date.

Youngkin’s critics previously accused him of abusing gubernatorial power when he directed the State Air Pollution Control Board to leave the Regional Greenhouse Gas Initiative absent legislation; for his withdrawal of the commonwealth from adherence to California’s vehicle emissions regulations; and for racking up the highest veto tally of any Virginia governor in recent history.

Davis said Virginia needed the energy bank to make it more competitive in the energy innovation sector.

“There’s insufficient private capital right now coming to the commonwealth of Virginia, in part because some of these projects are still a little bit too risky and lack of capital has been disincentivizing new companies from coming to Virginia,” Davis said.

Davis said similar banks already exist in 20 other states. Virginia also needed the bank in order to take advantage of federal funding that has recently become available.

Looking forward, Davis said they’ve mapped out what the rest of 2024 will look like for the bank.

The first half of 2025, according to Davis, will include securing awards from partner groups, issuing standing RFPS and “underwriting disbursement for monies and transactions with our key partners.” For the latter half, the department plans to scale "the organizational size of the bank and play a more proactive role in shaping the market.”

“We’ll be solidifying the bank’s role in not just the state government, but as a clean energy finance ecosystem throughout the commonwealth,” Davis said.