NY AG Letitia James suit against JBS may have exposed fatal flaw in companies' net-zero commitments

Consumers’ Research, a consumer advocacy nonprofit, sent letters to three major companies that have made similar commitments to warn them they are exposing themselves to potential litigation.

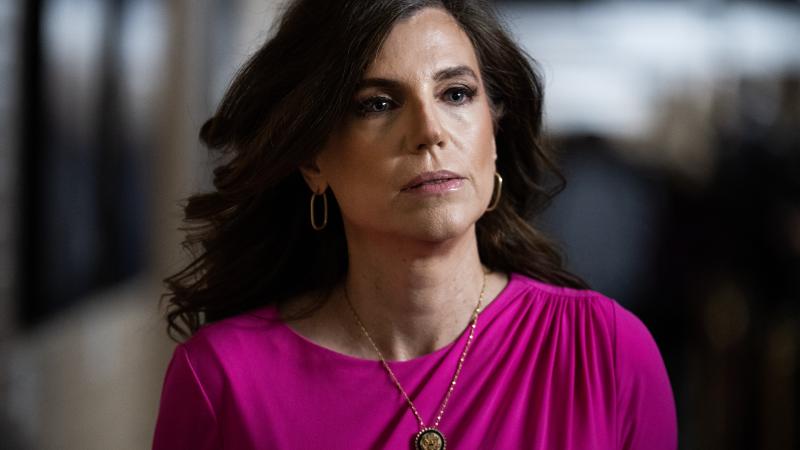

When New York Attorney General Letitia James filed a lawsuit against beef giant JBS Foods, alleging deceptive practices over its commitment to achieve net-zero emissions, she might have inadvertently given companies another reason to resist ESG commitments.

Consumers’ Research, a consumer advocacy nonprofit, sent letters to three major companies that have made similar commitments to warn them they are exposing themselves to potential litigation.

Now, attorney generals in four states are contacting those companies to say the comparisons between their statements and those of JBS are “stark” and “raise real concerns.”

No proven practices

JBS Foods advertises its commitment to have its operations reach net-zero greenhouse gas emissions by 2040. This includes reducing emissions in all JBS facilities by 30% by 2030 and using 100% renewable electricity by 2040.

In her complaint, James states that the company had no plan to reach net zero by 2040, and even if it had, JBS “could not feasibly meet its pledge because there are no proven agricultural practices to reduce its greenhouse gas emissions to net zero at the JBS Group’s current scale.”

The complaint also argues that offsetting those emissions would be very expensive, “of an unprecedented degree.”

In other words, according to the lawsuit, it’s impossible for JBS to produce beef at the scale the company does without producing emissions, and any plan to eliminate those emissions would be cost-prohibitive. This is precisely the argument net-zero critics are making about all big industries.

Many companies, however, make such commitments, and climate activists are pushing back against what they call “greenwashing.” Greenwashing, according to the anti-fossil fuel NRDC, is “the act of making false or misleading statements about the environmental benefits of a product or practice.”

James’ lawsuit unintentionally raises the question, should companies make sustainability and ESG commitments if they cannot produce their products at scale without emissions, and will go bankrupt if they try – and get sued when they can’t.

Virtue signaling

Consumers’ Research has been raising concerns about how ESG commitments potentially harm agricultural operations and drive up costs, which they argue ultimately get passed down to the consumer. In July, the group launched a six-figure advertising campaign to raise awareness of the impact ESG has on America’s farms and Americans' grocery bills.

After James announced her suit, the group noticed that there was nothing unique about JBS’s ESG commitments. Many other food companies have made similar statements. So Consumers’ Research sent letters to a few of these companies warning them that if JBS can get sued for its sustainability commitments, any company with similar commitments may be exposing itself to litigation if it cannot in fact live up to those promises.

“They shouldn't have taken on, for virtue-signaling purposes, a promise that they can't meet. But now is the opportunity for them to walk that back. And that's why we wanted to send those letters to help them understand the consequences,” Will Hild, executive director of Consumers’ Research, told Just the News.

Costly litigation harms the consumer, the letter argues, and one outcome of the litigation is the removal of food products from store shelves to meet climate commitments that should never have been made in the first place.

The letters were sent to the CEOs of Ahold Delhaize, Target, and Tysons Foods. They explain James’ lawsuit, and then show how JBS’s claims align with statements made by the company receiving the letter.

For example, JBS claims it is “the first major global protein company to set a net-zero GHG emissions by 2040 target,” covering emissions along all its supply chains, including those from its suppliers, known as Scope 3 emissions.

Tysons states that its “ambition is to achieve net-zero GHG emissions, including Scopes 1, 2 and 3 emissions, by 2050.”

Target’s sustainability commitments promise to achieve net zero “across our enterprise by 2040 to reduce climate impacts across our operations and supply chain.” Ahold Delhaize, whose brands include Food Lion and Giant Food, also promises net zero by 2040.

The letter proposes that instead of “continuing to mislead consumers with unrealistic goals” and risking litigation, the companies’ leadership should reassess their ESG statements and recommit to providing affordable, high quality products to consumers.

Growing concern

Hild said that the goal is that consumers don’t get double charged for ineffective investments in trying to reach net zero, then possibly for the costs of litigation when they get sued.

The arguments Consumers’ Research made in the letters got the attention of the attorney generals of Iowa, Kansas, Nebraska and Tennessee.

The AGs sent letters to the same companies, warning them of the “growing concern” surrounding companies making misleading statements and the states’ consumer protection laws. The AGs also ask the companies to confirm whether the statements Consumers’ Research cites reflect their current commitments and to supply any commitment or pledges to net zero that the company has in effect.

“Knowing your company’s positions and statements going forward is crucial to our current analysis of how to respond to the ongoing concerns raised by this Consumers’ Research letter,” the AGs letters state, giving the companies until Oct. 11 for a response.

Just the News reached out to the companies for comment on this article but didn’t receive a response.

Full retreat

Many companies are quietly retreating from sustainability commitments. Net Zero Tracker cheered when the number of companies with net zero targets rose 40% between June 2022 and October 2023, surpassing 1,000 companies from within the Forbes Global 2000 list of the world’s largest companies.

The problem is that it’s very easy to promise net zero, and it’s another thing entirely to actually deliver. The same study also noted that only 4% of those companies demonstrate any clear plan to reach those goals. A survey by Bain & Co. found that with CEOs sustainability has taken a backseat to concerns about inflation, artificial intelligence and geopolitics.

Morgan Stanley, Bloomberg reports, quietly omitted an ESG pledge to facilitate the prevention, removal or reduction of 50 million metric tons of plastic waste by 2030. A Bloomberg Intelligence analysis found that most U.S. companies have significantly scaled back their discussions of ESG and similar topics in quarterly earnings calls. Google this year stopped claiming to be carbon neutral.

Bloomberg quotes experts arguing the shift is due to a change in political winds as ESG gains a bad reputation and that a different approach to the same agenda is needed.

However, Google removed its claim to be carbon neutral as the energy demands of A.I. made it clear the company couldn’t innovate in that realm and maintain its net zero commitments.

Many companies may find that growth and profitability are inextricably linked to their emissions, and there may be no way to have their cake and eat it too. Or as activists push back against "greenwashing," they may just get sued for promising more than they can deliver.

The Facts Inside Our Reporter's Notebook

Links

- filed a lawsuit

- Consumersâ Research

- net-zero greenhouse gas emissions by 2040

- precisely the argument net zero critics

- according to the anti-fossil fuel NRDC

- six-figure advertising campaign

- sent letters

- Ahold Delhaize

- Target

- Tysons Foods

- JBS claims

- Tysons states

- Targetâs sustainability commitments

- promises net zero by 2040

- June 2022 and October 2023

- survey by Bain & Co.

- Bloomberg reports

- stopped claiming to be carbon neutral

- ESG gains a bad reputation