Texas AG Paxton files lawsuit alleging BlackRock and other firms colluded to hurt coal industry

According to the lawsuit, the three asset managers acquired substantial stockholdings in coal companies, and then used their influence to pressure the companies to adopt ESG goals and reduce output.

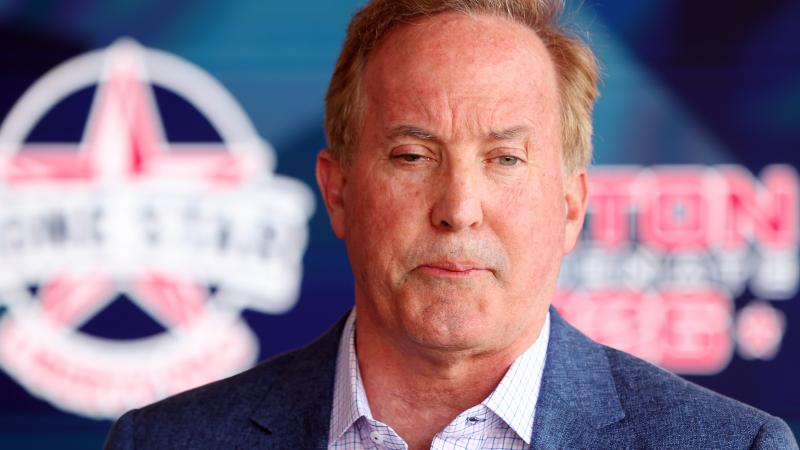

Texas Attorney General Ken Paxton, along with 10 other state attorney generals, have filed a lawsuit against BlackRock, State Street Corporation, and Vanguard Group, three of the largest institutional investors in the world.

The lawsuit filed Tuesday alleges the firms conspired to artificially constrict the market for coal through anti-trade practices.

“Texas will not tolerate the illegal weaponization of the financial industry in service of a destructive, politicized ‘environmental’ agenda. BlackRock, Vanguard, and State Street formed a cartel to rig the coal market, artificially reduce the energy supply, and raise prices, Paxton said in a statement.

"Their conspiracy has harmed American energy production and hurt consumers. This is a stunning violation of State and federal law."

According to the lawsuit, the three asset managers acquired substantial stockholdings in every significant publicly held coal producer in the United States. This gave them influence over the policies of these companies, and they used their combined influence to pressure coal companies to adopt emissions-reductions goals and reduce coal output by more than half by 2030.

“Blackrock, Vanguard, and State Street utilized the Climate Action 100 and the Net Zero Asset Managers Initiative to signal their mutual intent to reduce the output of thermal coal, which predictably increased the cost of electricity for Americans across the United States,” Paxton also argues in announcement of the lawsuit.

Vanguard did not respond to requests for comment, but a spokesperson for BlackRock denied the allegations, calling them “baseless.”

BlackRock says the company is "deeply invested in Texas' success. On behalf of our clients, we have billions invested in Texas energy, partnering with the state to attract investments into the Texas power grid and helping millions of Texans retire with dignity.

"BlackRock's holdings in energy companies are regularly reviewed by federal and state regulators. We make these investments on behalf of our clients, and our focus is on delivering them financial returns."

The company spokesperson also said the company would invest money in companies with the goal of harming them “defies common sense."

BlackRock also said: “This lawsuit undermines Texas' pro-business reputation and discourages investments in the companies consumers rely on."

A spokesperson for State Street said the company works in the long-term financial interests of its investors, and focuses on enhancing shareholder value.

"As long-term capital providers, we have a mutual interest in the long-term success of our portfolio companies. This lawsuit is baseless and we look forward to presenting the facts through the legal process," the State Street spokesperson said.

Will Hild, executive director of Consumers’ Research, a consumer advocacy nonprofit, thanked Paxton for the legal action.

“Today's lawsuit is a bombshell to the ESG asset manager cartel…As we've been saying all along, ESG isn't an investment strategy, it's a conspiracy against the public,” Hild said.