GOP Sen. Marshall decries SVB managers: 'You can't fix stupid'

"I think that there's gross mismanagement there at that bank," Marshall said.

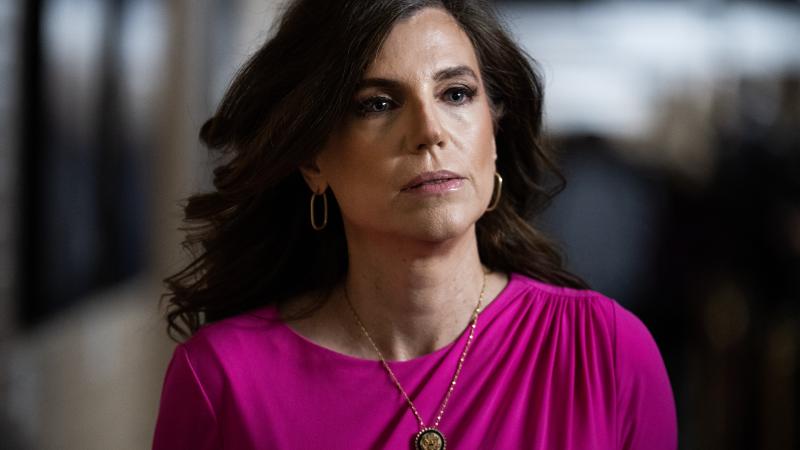

Kansas Republican Sen. Roger Marshall excoriated the managers of the failed Silicon Valley Bank on Tuesday for not managing risk effectively and rejected the notion that taxpayers would not foot the bill for a federal intervention.

"I think that there's gross mismanagement there at that bank; this has nothing to do with the regulatory environment," Marshall said during an appearance on Fox Business's "Mornings with Maria," "We don't need more regulations. You can't fix stupid and an aggressive out of control board, and that's exactly what they had there. They did not manage the risk properly."

Silicon Valley Bank failed Friday and Signature Bank failed Sunday, generating panic among depositors and prompting talk of a federal bailout to avert a financial crisis comparable to that of 2008. SVB was a strong proponent of environmental, social and governance (ESG) investing, a practice of choosing investments using social criteria, independent of its profitability. The practice has faced scrutiny over possible conflicts between a firm's ESG goals and its fiduciary duty to investors.

In addition to its ESG investing, SVB also heavily invested in securities and other items impacted by interest rates, which the Federal Reserve has repeatedly raised in recent months to combat inflation. That bet did not pay off.

In a bid to save depositors, the Treasury has vowed that the Federal Deposit Insurance Corporation (FIDC) would insure deposits beyond the congressionally-set $250,000 maximum, though that plan faces legal hurdles and former Treasury insiders have questioned the authority of the government to enact such a plan.

Also drawing scrutiny is the claim that a federal intervention will not result in taxpayer's shouldering the burden of a bank bailout. Marshall took exception to this pledge in particular, saying "[i]t is absolutely a bailout...again, community banks across the nation are bailing out depositors in Silicon Valley, California, New York, maybe even perhaps from China."

"They're going to pass that fee on to community banks, all every bank in America, and then that'll be eventually passed on to the, to the depositors," he continued.

The FDIC is reportedly short of the necessary cash to cover the combined deposits of both banks. President Joe Biden has insisted that the FDIC will fund the remainder with fees the banking industry pays to the insurer, though critics say those fees will trickle down to small banks and average customers.

Ben Whedon is an editor and reporter for Just the News. Follow him on Twitter.