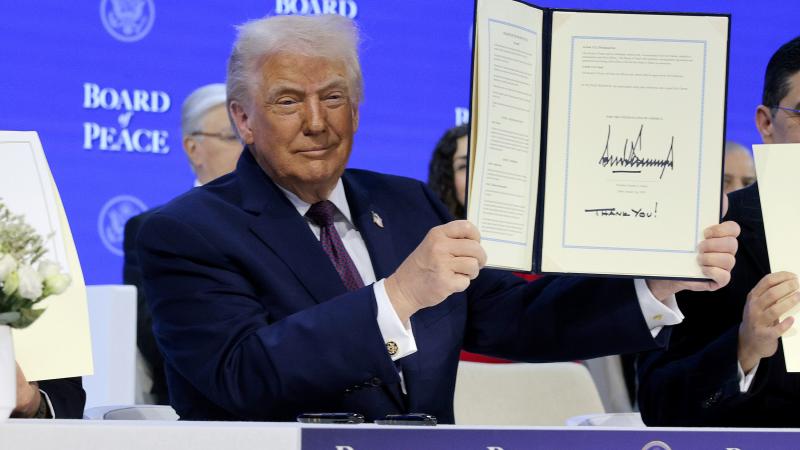

Biden, Democrats require Venmo, PayPal, others to report $600 or more of payments to IRS

The law was included in the Democrats' $1.9 trillion American Rescue Plan Act, which was passed with only Democratic votes through budget reconciliation to avoid the Senate filibuster

President Joe Biden and Democrats in Congress passed a new rule that requires payment companies and cash applications such as Venmo and PayPal to report $600 or more of payments to the Internal Revenue Services.

The law was included in the Democrats' $1.9 trillion American Rescue Plan Act, which was passed with only Democratic votes through budget reconciliation to avoid the Senate filibuster. The new rule took effect at the beginning of this month.

The requirement covers payments received for good and services. The rule would apply to payment services like PayPal, Venmo, Zelle, Cash App and others.

Payment companies were required to only send users 1099-K forms "if their gross income exceeded $20,000 or they had 200 separate transactions within a calendar year," according to Fox Business News.

The Democrats had considered a similar requirement for financial institutions to report more than $600 of activity in bank accounts to the IRS as a way for pay for their multi-trillion Build Back Better Act. The policy was ultimately abandoned by Democratic leaders.