Rubio explains why a business isn't required to prove it's losing money to qualify for a PPP loan

Some people abusing the PPP program 'may slip through the cracks,' Rubio said, 'but the overwhelming majority of this is going to people who really need it'

Sen. Marco Rubio (R-Fla.), a key architect of the Paycheck Protection Plan, said Congress didn’t require businesses to prove they're losing money due to the COVID-19 pandemic because such a rule would “disproportionately” hurt smaller-sized businesses.

Rubio, chairman of the Senate Committee on Small Business & Entrepreneurship, acknowledged that there will be “unintended consequences” of the program but said it has been successful overall.

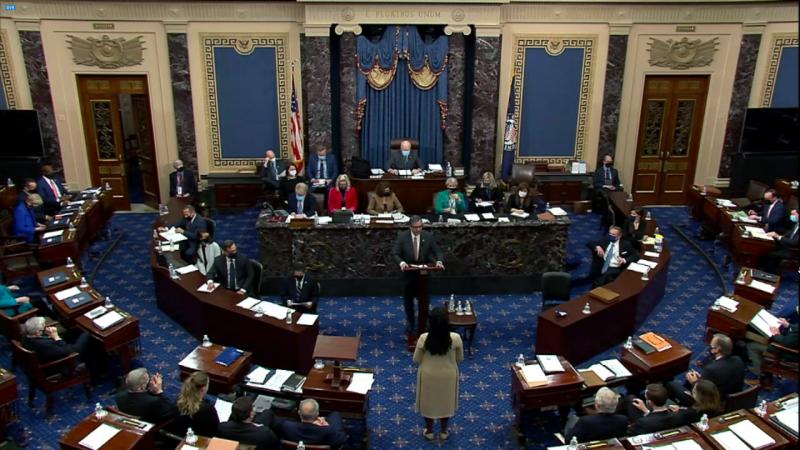

The PPP program received $350 billion in the $2.2 trillion CARES Act. The Senate passed an additional $310 billion with a voice vote on Tuesday since the initial funds have already been spent.

Critics of the program argue that businesses under 500 employees applying for the forgivable loans should have had to prove how much their operations have been hurt by coronavirus.

“A lot of people have asked, well, why don’t we require businesses to prove that they’re losing money? We thought about that. We talked about it extensively,” Rubio said on a conference call organized by the Jewish Council for Public Affairs on Tuesday.

“Here’s the issue: if I go in to apply and you tell me ‘I need to see three months of financials’ to see if your revenues now are substantially down from what they used to be, my sense is, larger more sophisticated businesses will be able to do that. It gives the bankers more work. It is more delay but they could do it,” he added.

Rubio said he doesn’t know how many “mom and pop” small businesses could produce monthly financial statements in a timely fashion for lenders.

“On the one hand you don’t want to open this thing up to everybody getting it that doesn’t need it but on the other hand the more paperwork you require, the longer it’s going to take,” Rubio said.

“And I assure you, if we had put that paperwork requirement, it would have disproportionately benefited more sophisticated businesses and even they would be stuck in longer delays,” he added.

According to Fast Company, “the Office of the Comptroller of the Currency, an independent bureau within the Treasury Department, is asking banks to weigh in" on how the PPP loan process "could be improved” to better identify fraud.

Rubio explained that businesses have to check a box on the Small Business Administration application form to certify that their operations have been harmed by COVID-19 and said those abusing the program would face consequences.

“If there are people out there abusing on this – you know, they’re making the same revenue as ever, there’s no reason to believe they won’t continue that – then you get in trouble for abusing the program,” he said. “Some may slip through the cracks in that regard but the overwhelming majority of this is going to people who really need it.”

Rubio said the program is working, overall, as Congress intended despite any mistakes that might be made.

“They [lenders] made 14 years worth of loans in 11 days, reaching over 1.6 million businesses representing, by some estimates, 30 million jobs. The average loan is about $200,000,” he said.

“Ultimately the goal here was, in an emergency situation, you want to help as many people as you can and you don’t have time to try to get it perfect because the only thing worse than these mistakes, far worse, is inaction.”