Mark Wahlberg's mentor accuses SEC of using kangaroo-court retaliation for criticizing pharma

Lawsuits allege federal agencies are violating Supreme Court precedents, with SEC trying to "unilaterally" punish celebrity hedge fund manager exonerated by jury and FDIC prosecuting a guy over whom it has no authority.

A millennium after the filioque helped formally split Western and Eastern Christianity, the Securities and Exchange Commission unilaterally changed the meaning of America's founding creed to split a Greek Orthodox priest from his constitutional rights, a new lawsuit argues.

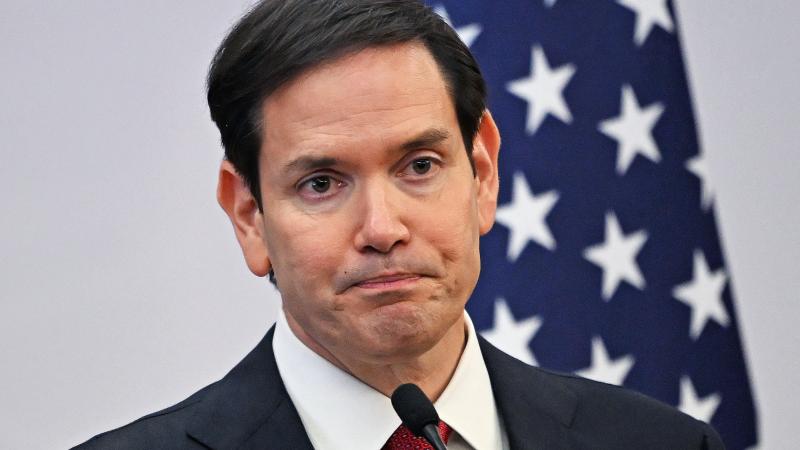

The SEC retaliated against the Rev. Fr. Emmanuel Lemelson, a hedge fund manager and activist investor, for accusing the agency in an open letter to Congress of "incompetency and financial illiteracy" on par with its "botched Enron and [Bernie] Madoff investigations" by failing to investigate alleged fraud by a pharmaceutical company, his lawyers argue.

It's trying to "unilaterally" punish Lemelson, whose mentorship of the actor and paid prayer enthusiast Mark Wahlberg is featured in an HBO Max docuseries, in a "follow-on administrative prosecution" after a jury rejected "all its incendiary allegations that he engaged in a scheme to defraud the market and even his own fund investors," the New Civil Liberties Alliance says in the suit.

The SEC secured a final judgment in 2022 that only bars Lemelson from violating provisions of the SEC Act and its own regulation for five years and makes him pay a $160,000 "third-tier" civil penalty, a far cry from the $2.6 million in penalties and disgorgement and "permanent, lifelong injunction" the agency demanded, the suit emphasizes.

It "forever" forfeited its right to ban Lemelson from the securities industry by not seeking that outcome in court, yet weeks after the final judgment the SEC launched a new proceeding in its own kangaroo court against a "longstanding nemesis" the agency has "demonized in demonstrably false press releases," NCLA says.

The public interest law firm filed a similar suit against a little-understood agency on behalf of another client the week before.

The Federal Deposit Insurance Corporation has kept John Ponte "trapped in an unlawful administrative enforcement proceeding" even after the Supreme Court ruled that Americans can bring "structural constitutional claims" against agencies in federal courts and they have a right to a jury trial in enforcement actions seeking civil penalties, NCLA alleges.

It's seeking a temporary restraining order against the FDIC, arguing the administrative law judge who presided over Ponte's in-house proceeding is "illegitimate" and he's not even subject to its authority, given that Ponte is "neither a banker nor does he own or control any banks."

SEC spokesperson David Ausiello declined to comment on the Lemelson lawsuit. FDIC spokesperson Brian Sullivan told Just the News "we customarily decline comment on matters related to pending litigation or other ongoing legal matters."

Both suits invoke major NCLA victories at the Supreme Court in the past year and a half, though the FDIC case relies much more heavily on them.

Those decisions let enforcement targets of federal agencies challenge the constitutionality of their in-house judges in real courts amid administrative adjudications, grant them jury trials and ban lower courts from deferring to agencies' own interpretations of their authority.

Walhberg's mentor has the "statutory right to at least an evidentiary hearing to determine facts that could affect his ultimate punishment," and the U.S. District Court in D.C. should also find the SEC prosecution violates separation of powers and Lemelson's Fifth and Seventh amendment rights, the suit says.

Administrative proceedings are "ultimately adjudicated by the SEC commissioners themselves, sometimes after" ALJs initially rule, while agency prosecutors are held to the weaker preponderance-of-evidence standard and can skip the "non-jury evidentiary hearing ostensibly required by" the Administrative Procedure Act and SEC's own Advisers Act, NCLA says.

"The appearance and reality of a stacked administrative deck, and of SEC’s intractable adjudicative bias against Lemelson, could not be clearer," the firm says.

The SEC appear has been out to get Lemelson since Ligand Pharmaceuticals complained about his "withering public criticism of the company," with the agency not only making "a recklessly false allegation that a federal jury eventually rejected" but launching a "years-long parallel media campaign to further demonize him" in its public statements, the suit says.

It portrayed him as a "religious charlatan" as well as a fraudster and hid the fact that the jury rejected "most of" its case in a defamatory press release headlined "SEC Wins Jury Trial," which repeated the very allegations the jury rejected, NCLA says. (The agency later revised the headline but still claimed it won the jury trial.)

The trial judge ruled against Lemelson's motion to recover attorneys' fees and costs from the SEC, which he has appealed, despite finding him the "prevailing party" under a law intended to give David a fighting chance against the taxpayer-funded federal Goliath.

Its staff attorneys in the follow-on proceeding "are the very same" who advised and represented the agency, "and continue to do so," in the federal court prosecution, meaning they have "likely engaged in multiple ex parte attorney-client communications" with commissioners about the case going back six years, the suit says.

The agency could immediately bar or suspend Lemelson under its interpretation of its own rules and further prosecute and punish him, "the only person currently capable of managing its assets," if he kept running the small fund, he says. The fund itself could also be prosecuted in that scenario.

The Facts Inside Our Reporter's Notebook

Videos

Links

- filioque helped formally split Western and Eastern Christianity

- new lawsuit argues

- open letter to Congress

- mentorship of the actor

- paid prayer enthusiast Mark Wahlberg

- final judgment in 2022

- NCLA says

- similar suit against a little-understood agency

- temporary restraining order

- challenge the constitutionality of their in-house judges

- grant them jury trials

- ban lower courts from deferring to agencies'

- "SEC Wins Jury Trial,"

- agency later revised the headline