As gas prices surge, blame game mostly ignores impact from new liberal financial policy

'Woke' investing concept seen as factor in Americans paying more at the pump.

With record gas prices devastating household budgets, President Joe Biden is deflecting blame, arguing Russia and corporate greed are the real causes. His critics, meanwhile, are pointing the finger at excessive government spending and the Federal Reserve for maintaining near-zero interest rates amid such spending.

According to experts, however, a little-known force that's been largely ignored by the political class is playing a massive role on Wall Street and is partly to blame for spike in gas prices.

That force is environmental, social, and governance (ESG) investing, the concept that investors should use these three broad categories when evaluating where to put their money, prioritizing certain values and "social responsibility" when making such decisions.

"The general premise of ESG theory is that corporations should deemphasize their traditional responsibility to maximize value for shareholders and instead make new, binding commitments to multiple alternative stakeholder groups," read a recent letter submitted by the Competitive Enterprise Institute think tank and others.

The letter commented on a rule proposed by the Securities and Exchange Commission (SEC) that would force corporations to radically expand their climate-change disclosures — a goal of past ESG activism.

Indeed, many investors now use ESG as a rating system to measure a company's advancement of policies designed to address climate change, increase corporate board diversity, and support a progressive "social justice" agenda, among other initiatives. ESG advocates seek to radically reduce carbon emissions and invest in renewable energy, hoping ultimately to eliminate fossil fuels.

One consequence of ESG has been the ongoing surge in gas prices, according to experts who spoke to Just the News.

"ESG has absolutely contributed to high energy prices," said Richard Morrison, senior fellow at the Competitive Enterprise Institute.

"The Biden administration supports a policy framework that calls for a total phase-out of fossil fuels, so it should not be surprising that energy companies — even ones currently flush with cash because of high prices — are not lining up to invest billions of dollars in the industrial infrastructure that would be necessary to increase supply and bring down prices."

Morrison said that expanding supply isn't just about more drilling for oil and gas — there also needs to be expanded refining and pipeline capacity, which isn't quick or easy to make happen.

"It might cost a company $5 billion to develop a large new refining facility which will only pay for itself after twenty years," he said. "Why would any corporate board greenlight such an investment when the White House is planning on a carbon pollution-free power sector by 2035 and net zero emissions economy by no later than 2050?"

The Biden administration has announced a "whole-of-government" approach to climate policy, which includes trying to drive financing and investment away from the oil and gas industry.

Part of that effort has included Biden's special envoy for climate, John Kerry, who has been pressuring banks and financial institutions not to make loans to U.S. oil and gas companies and embrace the commitment to a future economy of zero carbon emissions.

Earlier this month, the U.S average price for a gallon of regular gasoline passed $5 for the first time. The average was $4.97 as of close of business on Tuesday, according to figures from AAA.

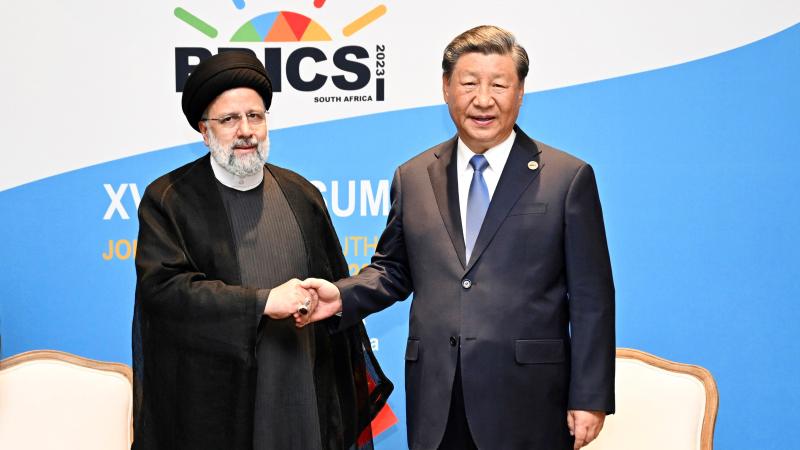

Biden has been criticized for turning to Iran and Venezuela as potential substitutes to fill the void after the U.S. and other countries cut back on Russian energy imports amid Russia's war against Ukraine. He's scheduled to travel to Saudi Arabia next month to discuss oil production with the Saudis in hopes of helping drive down gas prices.

Some observers have argued that the administration should be devoting its efforts to boosting domestic energy production rather than looking abroad.

"We believe that ESG is causing significant damage to our national security through a misplaced push to reduce domestic oil production," said Rashida Salahuddin, president of the Corporate Citizenship Project think tank.

"As a result, oil producing autocrats in Venezuela and the Middle East are strengthened, while Americans now have a less stable supply of much-needed energy. We don't pin 100% of the blame for high gas prices on ESG advocates, but we believe that they are in part to blame for our current predicament."

Others, however, point the finger squarely at ESG.

"Today's inflation really starts with ESG," Utah Treasurer Marlo Oaks said on Fox News last week. "Because if you think about why gasoline prices are so high, a lot of it is a supply issue. And the reason we don't have enough supply in this country -- one reason why -- is we don't have enough capital going into oil and gas projects."

ESG is the "only explanation that makes sense," Oaks said. "People have decided that they do not want to participate in the fossil fuel industry and so are cutting off capital. There is an active drive that we have heard from this administration, to cut off capital to the fossil fuel industry. It's very troubling."

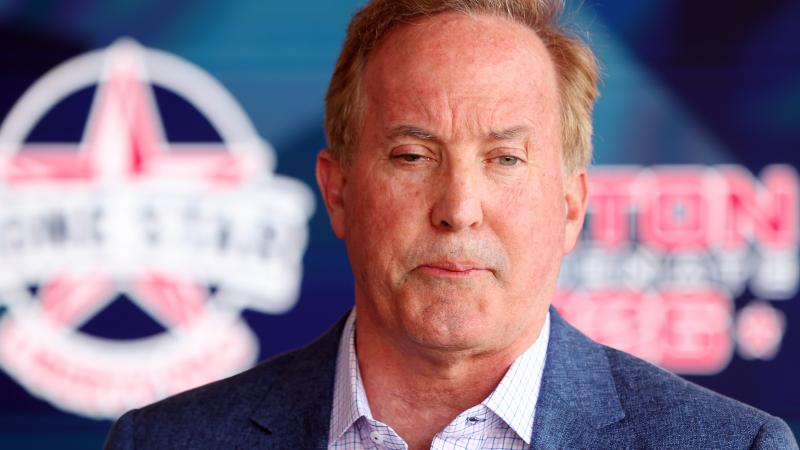

In April, Oaks coordinated an effort by political leaders across the state to send a letter to S&P Global Ratings President and CEO Douglas Peterson demanding that S&P withdraw ESG indicators as part of its credit ratings for states and state subdivisions.

"ESG is about controlling and forcing behaviors," Oaks said in a statement. "It attempts to do through capital markets what activists and their government allies have been unable to do through democratic processes. S&P should be concerned about whether investors will get paid back, not whether a state policy lines up with their political beliefs, whatever those may be."

But Edward Moya, senior market analyst for OANDA, told Just the News that, while some of the surge in gas prices is due to lack of investment, politics has much to do with the effort to blame Biden and the green energy movement.

But in today's market, "there will need to be a ramp-up in crude oil production, a commitment to the so-called 'dirty' forms of energy," said Moya. "The energy transition away from fossil fuels is a long-term process. We might see ESG struggle in the short term."