Hidden reality of new jobs report: Americans taking side gigs to make ends meet amid soaring costs

"Collapsing real wages force many workers to moonlight to pay the bills," said economist Peter Schiff.

The Labor Department's newly released jobs report for July appeared to be good news for the economy — at first glance.

A dig below the surface, however, reveals a different picture: Americans, strapped for cash by inflation, taking on second jobs as families have less money to spend.

The economy added an unexpectedly high 528,000 jobs in July while the unemployment rate fell slightly to 3.5%, according to figures released by the Bureau of Labor Statistics on Friday.

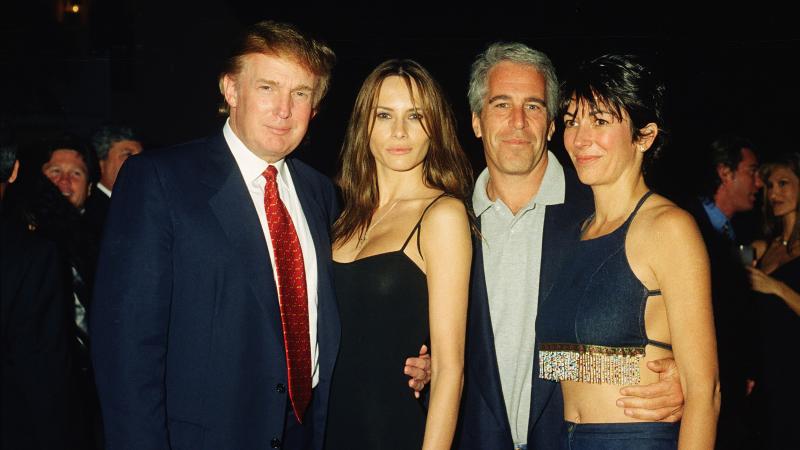

As a result, total nonfarm employment and the unemployment rate both returned to their February 2020 levels under then-President Trump before the COVID-19 pandemic.

President Biden touted the jobs report as evidence that his economic policies are working.

"Today, the unemployment rate matches the lowest it's been in more than 50 years: 3.5%," Biden said in a statement. "More people are working than at any point in American history ... and it's the result of my economic plan to build the economy from the bottom up and middle out."

Biden didn't note in his comments that the other time in the past half-century that the unemployment rate was as low as 3.5% was under his predecessor.

The strong jobs numbers will give the president and his supporters ammunition to argue the economy is not in, or on the verge of, a recession, despite the U.S. experiencing two straight quarters of negative economic growth.

However, a key reason for the high number of new jobs added in July — one not being discussed by the White House or most media outlets — is that a significant number of Americans are getting part-time and/or second jobs.

In other words, while the overall jobs figures look encouraging, the underlying reality is that most aren't full-time as families look for additional sources of income to weather historically high inflation.

From June to July, the labor force saw full-time jobs drop by 71,000, while part-time jobs and multiple jobholders increased by 384,000 and 92,000, respectively, according to the latest seasonally adjusted Labor Department data.

This trend of the economy dropping full-time jobs while adding second and part-time jobs has been accelerating since March.

American workers have been taking on second jobs as inflation continues to gnaw away at household budgets. Many people need the extra money just to pay for basic expenditures like food and gas.

Some 44% of Americans are working at least one extra job to make ends meet each month, according to a survey by Insuraranks, while 28% of respondents said they took on a secondary gig due to inflation.

Some observers have argued people holding multiple jobs is often a sign of them having more opportunities to pick up work. Others counter that the average person would only work multiple jobs because one job wasn't providing them enough money.

Beyond additional second jobs, the July jobs report also reveals a declining labor force participation rate, the percentage of the population that is either working or actively looking for work.

That figure dropped to 62.1% in July, which is substantially lower than where it was on the eve of the pandemic, 63.4% in February 2020 — a point that experts noted is critical when comparing the current economy to where it was before COVID-19.

The labor force is 623,000 Americans short of the participation level observed in February 2020, and if the rate was at a similar level to the average that existed in the year before the pandemic, there would currently be 2.6 million more workers in the labor force, according to the American Action Forum.

New York Times reporter Ben Casselman described the dip in labor force participation as a "discouraging sign for those hoping the strong labor market would bring workers off the sidelines."

Experts described the rate as "unfortunate" and a "warning," since it's falling most among the less educated and those who benefited the most from post-pandemic stimulus spending.

Adding to the problem is that workers' wages, while on the rise, haven't kept up with soaring inflation over the last several months. The result has been a decline in real wages, which haven't increased enough to match how much prices have gone up.

"For most Americans, their wages are going up, but they're not going up as fast as inflation," Minneapolis Federal Reserve President Neel Kashkari said on CBS's "Face the Nation" on Sunday. "So, most Americans' real wages, real incomes are going down. That's why families are finding it increasingly hard to make ends meet. When they go to the grocery store or when they buy necessities, they're not able to buy as much because they're getting a real wage cut because inflation is growing so quickly."

Inflation is at its highest level in four decades. In June, the Labor Department said real average hourly earnings decreased 3.6% over the last 12 months.

A key effect of lower real wages is reduced ability to buy products and services.

"We estimate that purchasing power of a median income household family is down about $4,000 over the past 14 months," economist Stephen Moore told Just the News. "This is a 'cost of living recession.'"

Moore, cofounder of the Committee to Unleash Prosperity, also appeared on the John Solomon Reports podcast last week and explained that inflation under Biden isn't hurting the ultra-rich.

"It's working-class people and people living on a fixed income, making less than $60,000 that are really feeling the heavy negative effects of this," he said, adding that the chief problem for Americans isn't finding a job but affording the cost of living.

Meanwhile, a new report by the American Consumer Institute's Center for Citizen Research reached a similar conclusion: that inflation will cost families $4,400 this year alone.

"The combination of increased spending, energy shortages, and increased regulations have led to increases in inflation that have far outpaced wage increases," said the report. "Based on our analysis and those of others, consumers are likely to lose thousands of dollars this year alone — by one measure, $4,400 per household in 2022 — disproportionately hurting poorer Americans and those on fixed incomes."

Amid a seemingly strong labor market, all these factors — second jobs, labor force participation, real wages, and household purchasing power — create a less rosy employment picture than the White House hopes, according to some economists.

"The gain of 528,000 jobs in July as the labor force participation rate fell to 62.1 means that most of the new jobs went to people who already had jobs," tweeted economist Peter Schiff. "Collapsing real wages force many workers to moonlight to pay the bills. If the labor market were strong one job would be enough."

Schiff added, "The 'strong' labor market can create a lot more low-paying service sector jobs if inflation destroys so much purchasing power that retirees have no choice but to go back to work and kids are forced to drop out of high school and get jobs to help their parents pay the bills."

Polling indicates inflation is causing Americans to feel economic pain.

A recent Harvard CAPS/Harris poll, for example, found 64% of Americans think their financial situation is getting worse. Other surveys have shown about six in ten Americans are living paycheck to paycheck.

Meanwhile, Biden's economic approval rating dropped to just 30%, according to a CNBC survey from last month.