Blue states suffer largest population, tax revenue losses, as red states see largest gains: IRS data

Wealthy residents appear to be the most likely to flee high-tax states.

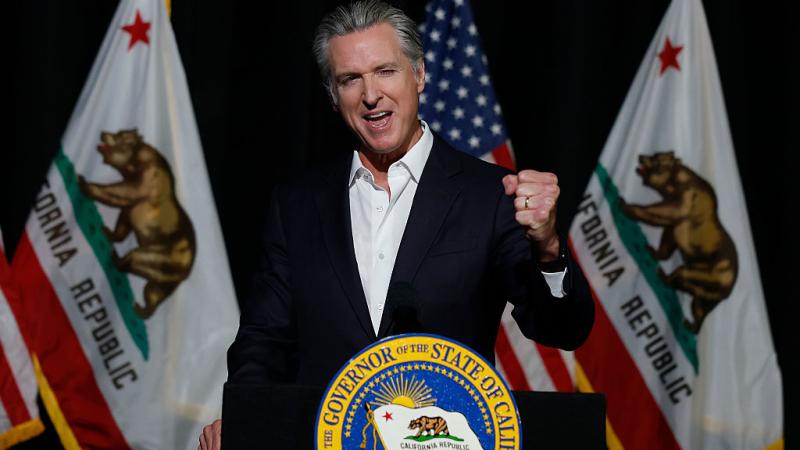

Even as Democratic governors such as California's Gavin Newsom and Illinois' J.B. Pritzker slam red state policies, their residents are fleeing in droves for Republican-run states.

IRS migration data released late last week shows that California lost more residents than any other state in 2021, with a net loss of nearly 332,000 people and more than $29 billion in adjusted gross income. The state with the second largest population loss is New York, which saw a net loss of over 262,000 residents and $24.5 billion in income. Illinois, meanwhile, suffered a net loss of 105,000 people in 2021 and $10.8 billion in income.

Other states saw population losses, albeit not to the same degree as the three most populous states.

Massachusetts, for example, had a net loss of 44,000 people and nearly $4.3 billion in income, while Louisiana lost 28,500 people and $861 million in income. New Jersey, which lost fewer people, had a higher income loss, with 26,000 fewer people and $3.8 billion less in income.

| State | Tax Returns | Individuals | Adjusted Gross Income |

|---|---|---|---|

| California | -158,220 |

-331,760 |

-$29.07 billion |

| New York | -142,357 |

-262,216 |

-$24.52 billion |

| Illinois | -53,910 |

-105,109 |

-$10.88 billion |

| Massachusetts | -25,029 |

-44,087 |

-$4.28 billion |

| Louisiana | -14,113 |

-28,502 |

-$861 million |

Florida gained the most residents, with a net gain of over 255,000 people and $39 billion in income, while Texas came in second with nearly 175,000 residents and $10.9 billion in income. Meanwhile, North Carolina had a net gain of nearly 77,000 residents, and South Carolina gained nearly 65,000.

| State | Tax Returns | Individuals | Adjusted Gross Income |

|---|---|---|---|

| Florida |

128,228 |

255,834 |

$39.19 billion |

| Texas |

82,842 |

174,866 |

$10.9 billion |

| North Carolina |

40,828 |

76,720 |

$4.54 billion |

| South Carolina |

29,981 |

64,724 |

$4.19 billion |

| Tennessee |

30,292 |

62,015 |

$4.15 billion |

The largest source of Florida's new residents was New York, IRS data shows, with 84,365 arriving from the Empire State. New York Democrat Gov. Kathy Hochul is well aware of her state's issue with residents fleeing to Florida. Last year, the New York Post reported, she joked while signing a bill about Holocaust education: "I just want to say to the 1.77 million Jews who call New York home: Thank you for calling New York home. Don't go anywhere or to another state. Florida is overrated."

Florida, which does not have state income taxes, also welcomed a significant number of high-income residents from New Jersey, California and Illinois, all states that are known for having high taxes.

Wealthy residents appear to be the most likely to flee high-tax states.

For example, residents who fled California made an average of $183,737, which is considerably higher than the state's median income of roughly $84,000.

Taxpayers leaving Illinois and New York made up to $40,000 more on average than those who came to the states, according to IRS data analyzed by The Wall Street Journal.

The problems facing wealthy Californians may follow them after they leave. State Democratic lawmakers introduced a bill earlier this year that would impose a wealth tax on the wealthiest residents, including for several years after they've moved from the state.

The most popular destination for those exiting California has been Texas, even as Newsom targets the red state for its gun laws and abortion policies.

The most popular destination for those leaving Illinois has been Florida, but that has not stopped Pritzker from criticizing the red state's governor. In February, he said Florida GOP Gov. Ron DeSantis "doesn't represent the values of the people in Illinois. ... In fact, he is the antithesis of that. He's demonstrated that he's homophobic, that he has tendencies to promote racism."

Madeleine Hubbard is an international correspondent for Just the News. Follow her on Twitter or Instagram.