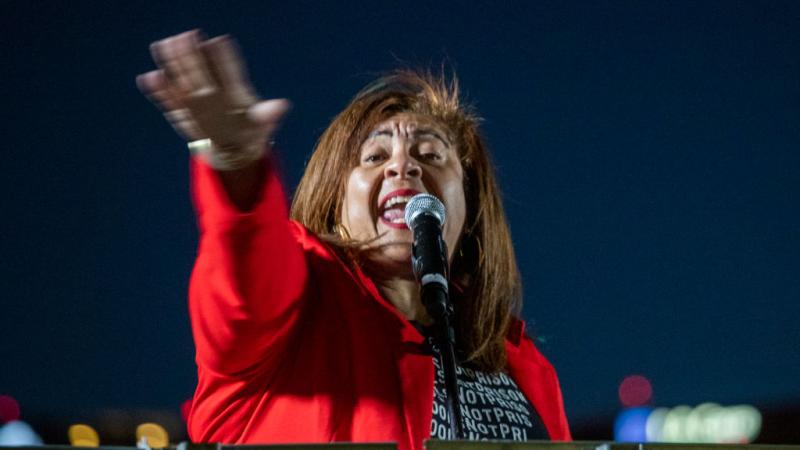

Democrat Gov. Hobbs vetoes ban on ESG investments in Arizona

Legislation would have required the state treasurer to list all state investments by name on a public site so that all investments might be made "in the sole interest of the beneficiary taxpayer."

Gov. Katie Hobbs has used her well-worn veto stamp on a bill that would have banned public investment funds in Arizona to do so through the lens of environmental, social and governance, or ESG, investing practices.

Hobbs vetoed Senate Bill 1500 on June 16. If enacted, it would have required the state treasurer to list all state investments by name on a public site so that all investments might be made "in the sole interest of the beneficiary taxpayer."

"We should not be donating to these causes [ESG]," Rep. John Gillette, R-Kingman, said. "We're investing this money as a return for the people of Arizona. This is a great bill to ensure that law is not violated."

The Republican-sponsored bill passed along party lines in the Senate 16-13 and 31-27 in the House before it met the governor's veto. SB 1500 was based on other states' legislative actions to bar investments related to ESG stocks.

"It really puts the onus on our investment managers, one example being our county treasurers, that now, every single investment can be called into question by anyone from the public who may simply disagree with the investment," Rep. Athena Salman, D-Tempe, said.

Arizona's attempt at halting the ESG movement is not the first. BlackRock recently lost $2 billion in investments from Florida after they divested, along with $794 million from Louisiana and $500 million from Missouri. Vanguard – a competitor of BlackRock – decided in December 2022 to withdraw from the ESG-centric Net Zero Asset Managers initiative, which would encourage firms to reach net zero carbon emissions by 2050.

"We have decided to withdraw from NZAM so that we can provide the clarity our investors desire about the role of index funds and about how we think about material risks, including climate-related risks—and to make clear that Vanguard speaks independently on matters of importance to our investors," Vanguard said in a statement.

ESG stocks have grown increasingly controversial as an undefined means of investing in social and environmental solutions through an index fund. Goldman Sachs, for example, states that its ESG fund keeps 80% of its assets out of alcohol, tobacco, weapons and fossil fuel companies. Detractors of the philosophy say it's an abdication of fiduciary duty.

Presidential candidate Vivek Ramaswamy, for example, argues that the only responsibility of companies is to maximize returns for shareholders.