Florida prohibits state retirement system from investing in funds that prioritize ESG

Vote comes after DeSantis announced in July a new plan to protect Floridians from banks and corporations pushing the ESG movement

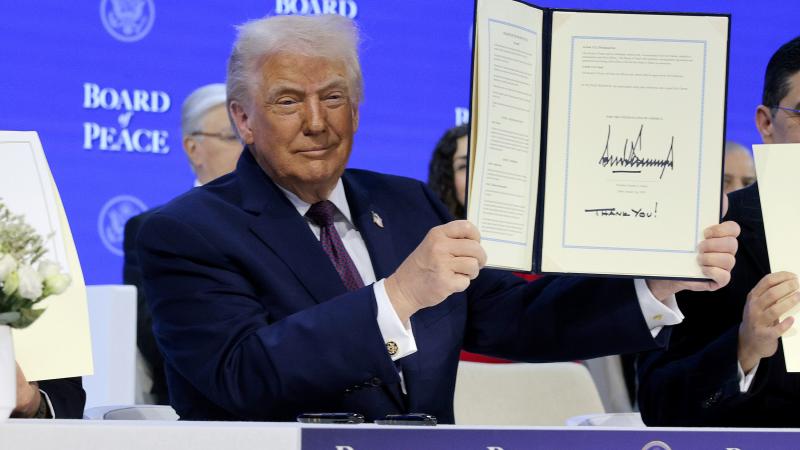

Gov. Ron DeSantis and the trustees of the State Board of Administration, CFO Jimmy Patronis and Attorney General Ashley Moody passed a resolution last week updating the state’s investment and proxy voting policies for its retirement system and pension plan.

The resolution prohibits state fund managers from investing in funds that comply with the ideological agenda of environmental, social and corporate governance (ESG).

The resolution also calls for an internal review of the state’s governance policies over the voting practices of the Florida Retirement System Defined Benefit Pension Plan.

The vote comes after DeSantis announced in July a new plan to protect Floridians from banks and corporations pushing the ESG movement, including new legislation for the 2023 legislative session.

One piece of legislation would amend Florida’s Deceptive and Unfair Trade Practices statute to prohibit discriminatory practices by large financial institutions based on ESG social credit score metrics.

While the Biden administration “has made clear its intention to encourage investment using ESG factors,” the resolution states, Florida “takes its fiduciary responsibilities seriously when investing state trust fund monies, particularly retirement fund money for our law enforcement, teachers, and public servants.” As a result of this commitment, the resolution states, Florida will only be allowed to “invest in funds in a manner that prioritizes the highest return on investment for beneficiaries, without consideration for nonpecuniary beliefs or political factors.”

The resolution defines pecuniary factors to exclude the consideration of the furtherance of social, political or ideological interests. It also directs the board to “not subordinate the interests of the participants and beneficiary to other objectives and may not sacrifice investment return or take on additional investment risk to promote any non-pecuniary factors” when making investments or proxy votes.

The resolution also instructs the SBA to “conduct a comprehensive review and prepare a report of the governance policies over the voting practices of the Florida Retirement System Defined Benefit Pension Plan, to include an operational review of decision-making in vote decisions and adherence to the fiduciary standards of the Fund.” The report is due no later than Dec. 15, 2023.

“Corporate power has increasingly been utilized to impose an ideological agenda on the American people through the perversion of financial investment priorities under the euphemistic banners of environmental, social, and corporate governance and diversity, inclusion, and equity,” DeSantis said. “With the resolution we passed today, the tax dollars and proxy votes of the people of Florida will no longer be commandeered by Wall Street financial firms and used to implement policies through the board room that Floridians reject at the ballot box. We are reasserting the authority of republican governance over corporate dominance and we are prioritizing the financial security of the people of Florida over whimsical notions of a utopian tomorrow.”

Last December, DeSantis, Patronis, and Moody voted to reclaim the SBA’s proxy voting authority from large financial firms including Blackrock, State Street and Vanguard. They also issued guidance to SBA employees responsible for proxy voting and investment decisions to ensure they were making decisions on behalf of Floridians in accordance with voters’ values, not “with the ESG mania taking hold of Wall Street and Washington.”