ESG groups co-release report pressuring insurance firms to avoid covering fossil fuel producers

The report suggests insurers "have a responsibility to ensure" climate change commitments.

Three pro-ESG institutions released a report this week targeting U.S. insurance companies that have fossil fuel-related assets and pressures these companies to "accelerate" the green energy transition.

ESG — which stands for Environmental, social, and corporate governance — encourages businesses use investor money to advance environmental and social justice goals. Critics say this is an abdication of a business’ fiduciary responsibility to deliver profits to shareholders.

The groups responsible for the report are Ceres, a nonprofit with an "Investor Network" subpoenaed by Congress in June for its aggressive ESG advocacy, consulting firm ERM’s Sustainability Institute, and "climate management" firm Persefoni. They accuse insurers of creating "financial and reputational climate-related risk" with their investing habits as well as underwriting that "helps greenhouse gas-intensive industries continue operations contributing to global warming."

The trio seems to lament that insurers have managed to avoid high levels of "scrutiny from climate activists," but warns that could change. However, they offer a proposed remedy: Going all-in on ESG.

"The U.S. insurance sector has not faced the same kind of scrutiny from climate activists as other asset managers," but "greater public focus on insurers as climate related policies may be on the horizon. By developing and disclosing the investment policies about fossil fuel-related assets, including policies shaping climate-focused shareholder engagement, insurers could reduce criticism and contribute more to the global shift to a low carbon future."

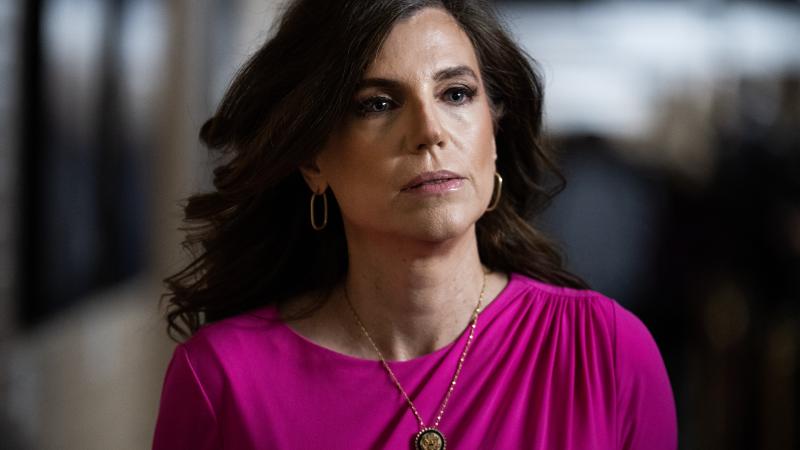

Western Energy Alliance president Kathleen Sgamma pushed back on this claim and the overall report, telling Just the News that insurers have indeed faced intense pressure to divest from fossil fuels and dismissed the research as a facade of risk management. Western Energy Alliance is a non-profit trade association and advocacy group that represents 200 independent oil and natural gas producers.

"Please… There's all kinds of pressure for financial institutions, including insurers, to not insure oil and gas," Sgamma remarked. "We have members that have had trouble getting insurance… We've been facing that for years."

There have been many well-documented cases over the years where insurers have fled fossil fuel projects. Last year, PBS reported that "62 percent of reinsurance companies — which help other insurers spread their risks — have plans to stop covering coal projects, while 38 percent are now excluding some oil and natural gas projects."

"Let's put aside any notion that this [Ceres] is an objective investor group that is concerned about investment risk," Sgamma also said. "They are concerned about pushing an agenda."

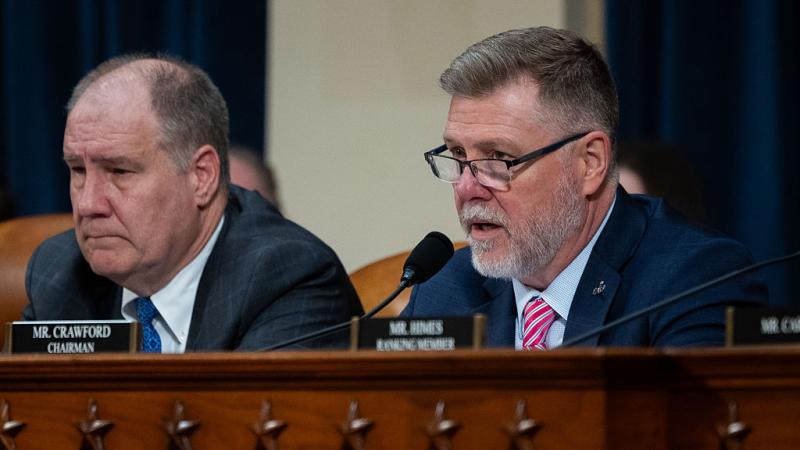

Roughly two months ago, Congressman Jim Jordan subpoenaed Ceres for potentially violating U.S. antitrust law by appearing to "facilitate collusion through Climate Action 100+." Ceres operates an "Investor Network" supported by more than 220 institutional investors managing more than $60 trillion in assets. Ceres' Investor Network manages the Climate Action 100+ project.

Network members include some of Wall Street's most well-known firms, including Bain Capital, Fidelity Investments and Kohlberg Kravis Roberts, as well as immensely wealthy public employee union funds, such as the Service Employees International Union, the California State Teachers' Retirement System and the American Federation of State, County and Municipal Employees.

In the research, Ceres and the two other groups decry "political headwinds" that pro-ESG companies face by citing a New York Times article condemning Republicans for criticizing Investor Network member BlackRock for championing "woke causes, including environmentalism."

Insurers, the report concludes, "have a responsibility to ensure" that who they invest with has "ambitious commitments" to reduce global emissions and further "climate action."

Ceres and outfits like it, Sgamma concluded, are "key clog[s] in the climate change machine."

"They provide this veneer of financial responsibility… but they’re about promoting an agenda whereby" a businesses’ main responsibility—delivering profits to shareholders—is abandoned.

Follow Addison on Twitter.