Feds waive financial assurances for offshore wind losses, leaving future costs to taxpayers

Financial assurance requirements ensure that taxpayers won't be on the hook for removing offshore wind towers if the company is unable to pay for it. The Bureau of Ocean Energy Management is waiving these requirements for offshore wind developers.

Danish wind developer Orstead announced Thursday it’s delaying construction on its Revolutionary Wind project off the coasts of Rhode Island and Connecticut. The news comes less than a year after the company already scrapped three projects over the commercial viability of the projects.

The offshore wind industry has been struggling financially for much of the past year, with companies’ stocks falling in part over uncertainty in the outcome of the U.S. presidential election. Inflation, supply chains and interest rates have also been blamed for the industry’s troubles.

Despite the financial uncertainty of the offshore wind industry, the Bureau of Ocean and Energy Management (BOEM) is issuing waivers for financial assurances on offshore wind projects, saying they present an unnecessary burden for the industry. The financial assurance requirement protects the public from decommissioning liabilities. If companies can’t afford to remove the wind towers they’re building after their useful life, the public has an assurance that those liabilities will be covered.

The agency issued a financial assurance waiver to Vineyard Wind, a 62-turbine project off the coast of Martha’s Vineyard. Public support for the project soured recently when a blade from one of the turbines broke off in calm weather and scattered foam, fiberglass shards and bits of potentially toxic epoxy across the beaches of Nantucket.

While offering waivers to the relatively new offshore wind industry, BOEM recently increased the financial assurance requirements for offshore oil and gas operations.

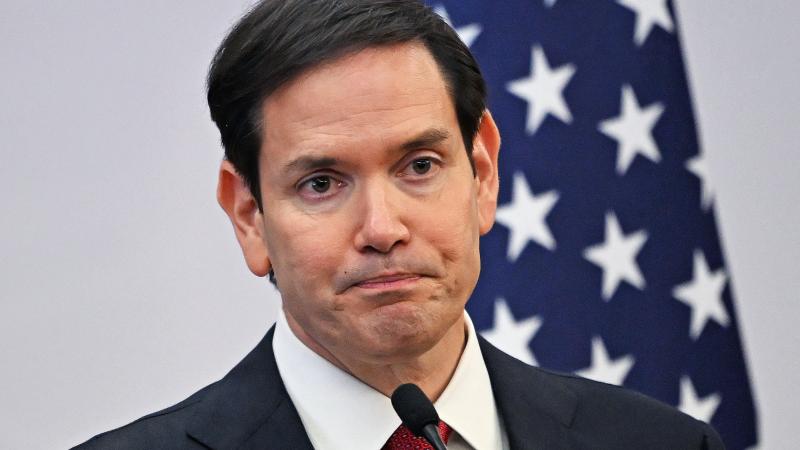

“The American taxpayer should not be held responsible when oil and gas companies are unable to clean up after their own operations,” said Interior Secretary Deb Haaland stated in an announcement on the new rules.

This “just shows that this administration is in the pocket of the wind business. It's just ridiculous how much favoritism they've shown this industry,” energy expert Robert Bryce told Just the News.

Proven technology

In 2017, Vineyard Wind requested a waiver to delay the assurances for 15 years after the project was built, and it was denied. They requested the same waiver in 2021 under the Biden administration, which is committed to building thousands of turbines up and down the East and West coasts, and the request was granted. The waiver citied long-term power purchase agreements, which guarantee the facility operators a set price for the electricity they produce over 20 years, “robust insurance policies,” and the “use of proven technology.”

As Elmer Peter Danenberger explains on his “Bud’s Offshore Energy” blog, the basis for this waiver could have applied to any offshore wind development, meaning the waiver set a precedent for the waiver to be extended to all offshore wind projects.

Danenberger reports that BOEM issued a rule in March to “streamline and modernize offshore renewable energy development,” which includes standardizing the waivers, and this will shift risk of these projects to taxpayers.

In the wake of the Vineyard Wind blade incident, Meghan Lapp, fisheries liaison and general manager at Seafreeze, Ltd., a fishing company based in Rhode Island, spoke at a hearing on offshore wind, organized by Reps. Jeff Van Drew, R-N.J., and Scott Perry, R-Pa.

“The truth is that BOEM habitually grants waivers or departure requests for these financial assurances. In fact, every project constructed or under construction in federal waters off New England have received these waivers: Vineyard wind, South Fork Wind farm. Revolution Wind and New England Wind off Massachusetts have also received a waiver,” Lapp testified.

Lapp was a plaintiff in the recent Supreme Court case that overturned the so-called "Chevron deference."

These waivers, Lapp pointed out, stand in stark contrast to the way BOEM treats oil and gas projects. Offshore oil and gas drilling is a much older industry, she said, and so many of the risks are known. But that’s not the case with offshore wind.

Lapp pointed to the impacts of the Vineyard Wind blade disaster and how it shut down beaches and impacted economies that depend on summer tourism. Despite BOEM claiming that offshore wind technology is proven, she said, the potential for blades to break off and cause such extensive environmental damages was unforeseen.

The crisis, she said, “underscores this lack of foresight and BOEM’s political push for offshore wind, regardless of cost to American taxpayers. If a decommissioning bond is a financial hardship for developers, what of the cost of cleanup liability and damages to local economies, businesses and citizens?”

Functional Government Initiative (FGI), a government watchdog, has been warning about the dangers of lowering decommissioning requirements for offshore wind development and the questionable assumptions upon which the waivers are based.

“I’m sure the residents and businesses of Nantucket aren’t enjoying serving as guinea pigs for the project’s ‘proven technology.’ The administration’s reckless push to get to ‘net zero’ has already driven fuel costs up. It’s frank about destroying livelihoods in the fossil fuel industry. Coastal economies like Nantucket’s may find they’re next,” Pete McGinnis, communications director with FGI, said in a statement.

Future liabilities

McGinnis told Just the News that the Vineyard Wind blade disaster should illustrate how the permissive approach to the offshore wind industry is creating serious problems for the future.

“In 2021, when the Biden-Harris administration licensed the first major US offshore wind project, Vineyard Wind was set to usher in the future of offshore wind energy and, by extension, the so-called Green New Deal. Instead, the project’s ongoing disaster could really be a harbinger of things to come. Internal documents have consistently shown Interior officials rushing through environmental reviews, waiving taxpayer protections, and downplaying concerns of local populations. How many other offshore wind projects suffer from these same deficiencies?” McGinnis said.

Lapp said at the hearing that she recalled that earlier documents from BOEM on the development of offshore wind alluded to the idea that the towers could just remain in place and become artificial reefs for marine life. That language has since been removed, she said, and they now refer to decommissioning as “construction in reverse.”

Construction costs, she said, are in the billions of dollars, which suggests decommissioning will be expensive. With waivers delaying financial assurances for 15 years, wind companies, she said, could collect the tax credits for that time and then sell the project off. So, the developer may be gone by the time the decommissioning liabilities come to bear.

These companies, she pointed out, are limited liability companies (LLC), and class action lawsuits for damages, such as those resulting from blades breaking off, could drive them into bankruptcy.

“And if they’re an LLC, they can just cut and run,” she said.

Rep. Perry, the Pennsylvania Republican, spoke about century-old coal mines in Pennsylvania, which operated before regulations required decommissioning assurances for such projects. They call the abandoned projects “stripping piles.” These have left behind groundwater contamination risks.

“They strip out the coal, and you got a big hole in the earth that fills with water and then junk cars or what have you, and it's there and and nobody owns it,” Perry said.

A lot of the companies developing offshore wind farms, he said, are foreign LLCs.

Lapp said that BOEM is engaging in an “across the board indifference” to the impacts the offshore wind is having on the East Coast, and potentially sticking taxpayers with the bill to clean up a mess in 20 years.

“We are now seeing a groundswell of democracy in action. It is time to take our ocean back. It is time to hold agencies accountable. We are not going to lose the Atlantic,” Lapp said.

The Facts Inside Our Reporter's Notebook

Links

- delaying construction

- scrapped three projects

- struggling financially

- stocks falling in part over uncertainty in the outcome

- financial assurance requirement

- issued a financial assurance waiver

- blade from one of the turbines broke off in calm weather

- increased the financial assurance requirements

- stated in an announcement

- energy expert Robert Bryce

- committed to building thousands of turbines

- issued a rule in March

- hearing on offshore wind

- Lapp was a plaintiff

- Functional Government Initiative

- has been warning about the dangers