West Virginia moves to boot Chinese companies from key state portfolio

Specifically, the board will move the emerging markets investment option to a fund that does not include Chinese firms.

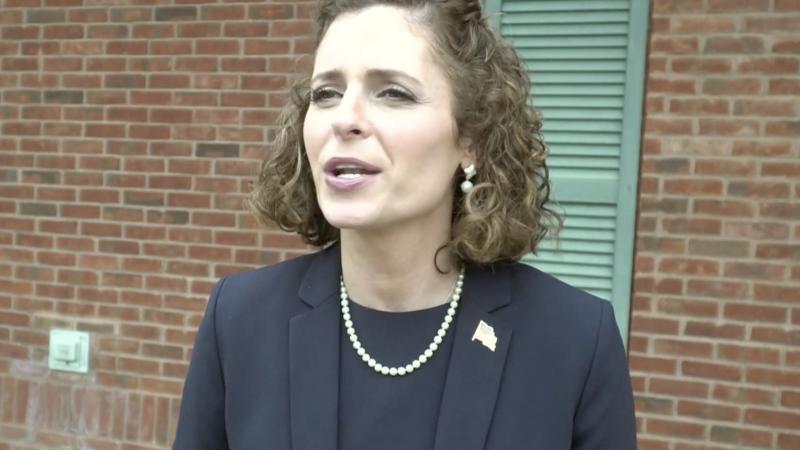

West Virginia Treasurer Riley Moore on Wednesday announced that the state would move to exclude Chinese firms from a portfolio of state funds in light of the increasingly adversarial relationship between Washington and Beijing.

"We have a fiduciary duty to act in the best financial interests of SMART529 plan participants, and we believe excluding Chinese emerging market investments from our Select Plan portfolio will help maximize returns while reducing exposure to the potential regulatory and geopolitical risks that come with investing in companies based in China," Moore said in a statement.

The SMART529 plan is the state's college savings plan fund that collectively includes $667 million, including $40 million in an emerging markets portfolio that has invested in companies either controlled or linked to China. Moore had proposed removing Chinese-linked firms from the portfolio, a plan the Board of Trustees accepted.

"I'm grateful to the Board members for carefully considering this recommendation to reduce exposure to these more risky Chinese investment options," he said.

Specifically, the board will move the emerging markets investment option to a fund that does not include Chinese firms, according to the West Virginia Record. Dimensional Fund Advisors, which directly manages the funds, created the Chine-free fund in late 2021.

Ben Whedon is an editor and reporter for Just the News. Follow him on X, formerly Twitter.