Democrats push for new automatic ‘direct cash’ stimulus payments to ‘smallest of small businesses’

Democrats say the new ‘rescue package’ would help businesses unable to secure forgivable PPP loans under CARES Act

A new proposal by congressional Democrats would provide the "smallest of small business" with automatic direct stimulus payments of up to $120,000, as the coronavirus pandemic continues to throttle the U.S. economy.

The new coronavirus “direct cash assistance” rescue package would be separate from the existing $660 billion Paycheck Protection Program, which was designed to provide forgivable loans to businesses with fewer than 500 employees.

Congress was lauded for its effort to promptly pass the PPP program to move money into the economy but it was also criticized for underfunding the program, which quickly ran out of funds and allowed big businesses to get loans such as Shake Shack, which is returning $10 million so it can be issued to smaller businesses. Media outlets also received more than $23 million in forgivable PPP loans.

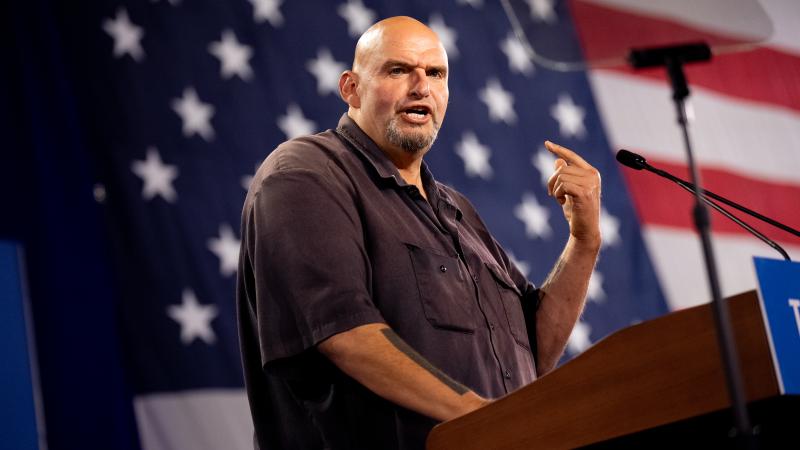

Under the Senate version of the plan, proposed by Oregon Sen. Ron Wyden, the top Democrat on the Senate Finance Committee, a stimulus payment of “30 percent of qualified gross receipts of such qualifying business," or $75,000, would be issued automatically to any business with $1 million or less in gross receipts for tax year 2018 or 2019. No action would be required on the part of the small business.

The House version of the plan, introduced by Rep. Madeleine Dean (D-Pa.), sets the gross receipts at $1.5 million and the maximum direct cash payments at $120,000.

The new stimulus bill defines an ‘‘eligible employer’’ as any business with less than 50 full-time employees “on the first day of the designated period” that has “conducted an active trade or business in a qualified coronavirus disaster zone.”

“We would like to see some modest amount of cash go to the smallest of small businesses,” Wyden said on Friday. “They might not be in a position or want to take on new debt in the Paycheck Protection Program.”

Rep. Dean said the timeline to “safely” reopen the economy will be “long,” so the smallest of small business need stimulus funding. Dean described the PPP program as “well-intentioned” but said it’s “simply not going to be enough.”

The Treasury Department has given large public companies who secured PPP loans until May 7 to return the money they have received.

Some chain restaurants such as Ruth’s Chris Steak House, with more than 500 employees, were able to secure forgivable PPP loans from the government because their individual locations had less than 500 employees. Ruth’s Chris Steak House has reportedly returned the funding it received.

“What I know now for sure is Congress has to do more to promote the agenda of the smallest of the small businesses in the next coronavirus package,” said Wyden, who voted in favor of the CARES Act that setup the PPP program. “There really hasn’t been funds getting to small companies.”

Wyden’s office told Just the News that the senator is working with congressional leaders to incorporate his legislation into any future coronavirus economic relief package.