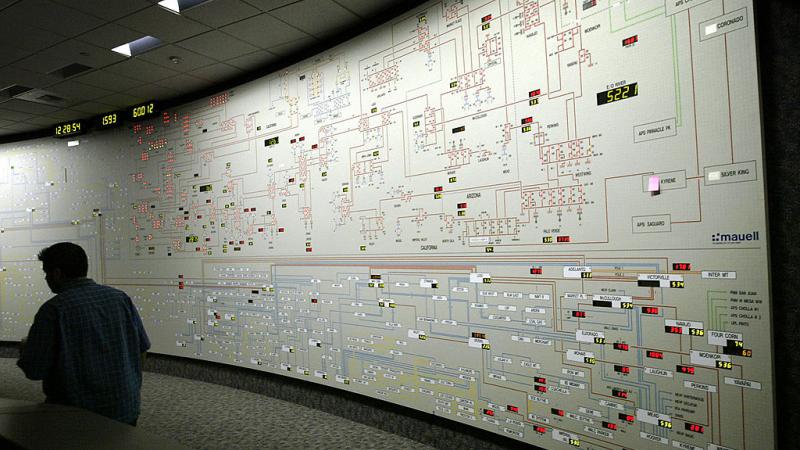

Treasury looking to improve, simplify compliance rules banks must follow to flag money laundering

The agency suggested new rules last week that would streamline U.S. anti-laundering regulations.

The Treasury Department is trying to fill a longstanding hole in its regulations against money laundering, which critics argue are cumbersome and cost-ineffective.

The department's Financial Crimes Enforcement Network (FinCEN) is asking for public comment on the government's requirement that all banks and financial institutions sustain an "effective and reasonably designed" anti-money-laundering program within their organization.

Under federal anti-money laundering regulations already in place, financial institutions are required to monitor and report suspicious activity to the government. According to the Wall Street Journal, that requirement has led to high numbers of low-value reports over the past 10 years.

FinCEN is attempting to modernize and clarify the United States' primary anti-money-laundering legislation, the Bank Secrecy Act, which several attorneys told the Journal can be unnecessarily cumbersome.

One attorney described current FinCEN regulations as "complex and onerous in certain ways that don't make sense." The agency will seek comments on potential reforms through Nov. 16.