Dow adds nearly 400 points as countries begin to reopen

Oil prices could be in trouble beyond just storage space

The Dow Jones jumped 375 points as the markets opened on Tuesday. The S&P 500 added 1.4%.

Investors' hope is up as countries around the globe begin taking actions to reopen their societies and economies. If the Dow can stave off any losses today, it will have achieved a five-day streak of gains.

U.S. futures stocks were up this morning, although oil prices continued to slip, even as several major countries move to reopen their economies.

U.S. crude futures for June are currently trading at $10.65 a barrel. The Chicago Mercantile Exchange raised its margin requirements for forward oil contracts, making it so that if oil dips below $10 a barrel margin calls could be triggered, which could encourage a continued sell off, which would send prices lower, and so on. Still, the problem goes beyond storage space for the world's oil reserves.

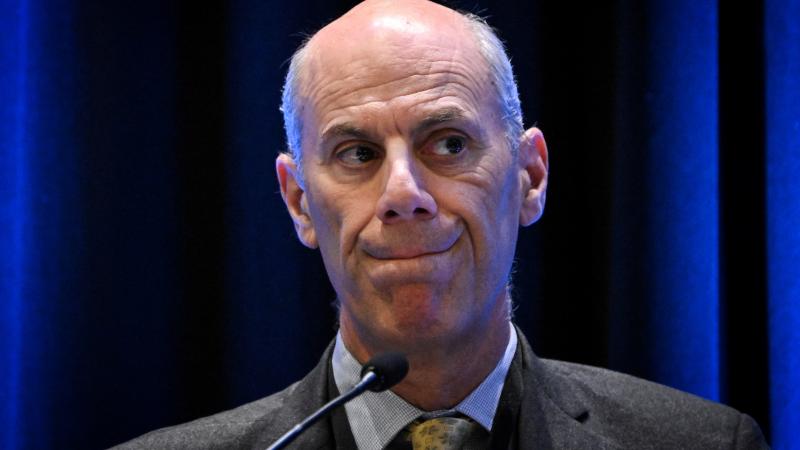

Earlier this morning, Treasury Secretary Steve Mnuchin spoke out about large, publicly-traded, and financially-viable businesses applying for and accepting loans from the government's PPP program.

"We're going to do a full audit of every loan over $2 million. This was a program designed for small businesses. It was not a program designed for public companies that had liquidity," he said on CNBC's "Squawk Box."

The secretary called the decision by the Los Angeles Lakers to take a $4.6 million government loan "outrageous." The Lakers were the second most-valuable team in the NBA as of 2020, with a valuation of $4.4 billion. The team reportedly said after Mnuchin spoke that it would return the money.

European markets were flat on Tuesday. The Stoxx Europe added 0.2%.