Dow plummets more than 1,800 points as fears of second virus wave hit the market

Treasury Secretary Mnuchin has made clear that U.S. 'can't shut down the economy again'

The Dow Jones Industrial Average on Thursday plummeted more than 1,800 points amid concerns about COVID-19 cases rising in some states.

The day's massive decline kicked off early in the day, when the Dow plunged 900 points at the Friday morning bell and the S&P 500 lost 2.5%.

The market drop-off follows two days of losses for the American exchanges, as fears escalate surrounding a second wave of the novel coronavirus.

Case numbers have been spiking in some states that have begun reopening efforts, as investors and the public watch carefully to see what the new numbers will mean.

Investors are also adjusting to the Federal Reserve's announcement Wednesday that it has no plans to change the interest rates nor increase the rates through 2022.

As a result of the increased coronavirus uncertainty, airline and cruise line stocks fell Thursday, as did some retail companies.

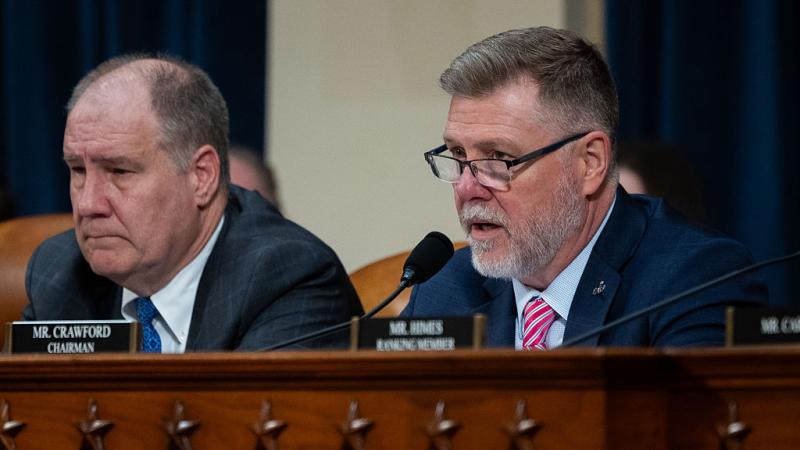

Treasury Secretary Steve Mnuchin weighed in on the issue, saying that the United States cannot close down the economy a second time.

"I think we've learned that if you shut down the economy, you're going to create more damage," Mnuchin told CNBC.

U.S. stocks recovered significant ground last week, experiencing five straight days of gains and a massive jump on Friday, following an unexpectedly good jobs report. The Dow and the S&P 500 remain up roughly 40% from their respective pandemic lows.

The weekly jobless claims report Thursday showed 1.5 million Americans filing for first-time unemployment benefits last week.

Though still a historically high number, the jobless rate has been decreasing each week and is miles away from the 7 million Americans who filed during the first week of April. The number of people receiving unemployment also decreased this week by 339,000.