Dodgers' first baseman Freddie Freeman loses $2M on home sale after taxes

A so-called mansion tax to get money for services that help the homeless or people in trouble sounds good. “But as we've seen, the money is intercepted by these Minnesota-style NGOs.

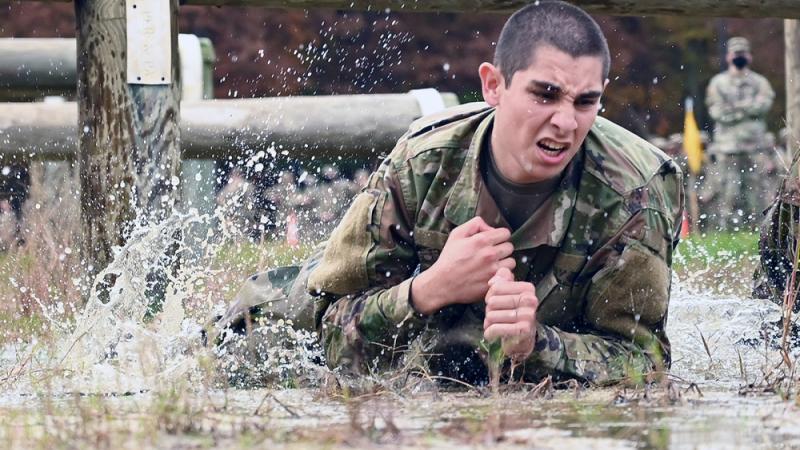

Selling a high-value property in Los Angeles? Tax experts advise caution: You could be in the same boat as Los Angeles Dodgers star Freddie Freeman.

The first baseman recently sold his Los Angeles home and lost $2 million due to fees and taxes.

Susan Shelley, vice president of communications at Howard Jarvis Taxpayers Association, blames an initiative tax known as Measure ULA that citizens got on the ballot in 2022 and managed to get approved.

Howard Jarvis is suing, but so far, the courts have upheld the tax.

“This is a transfer tax, a real estate transfer tax, to benefit homelessness and other kinds of services regarding housing or anti-eviction measures things like that, and the groups that get the contracts to do those things are the ones who paid for the initiative to pass this tax,” Shelley told The Center Square. “They called it a mansion tax, but it's not just on mansions. It's also on commercial real estate, apartment buildings, shopping centers, grocery stores, hotels, anything that's in that price range, about $5,000,000.”

It adjusts for inflation.

Right now, $5.3 million is the threshold for this tax, and it's 4% of the sale price whether someone has a loss on the sale or capital gain on the sale.

“It's a transfer tax just on the value at the time you sell, so even though he (Freeman) sold his house for less than he paid for it, he owes this mansion tax of 4% because the price was between $5.3 million and $10.6 million," Shelley said. "And if it had been in the price range above $10.6 million, it would have been a 5.5% tax.”

That, said Shelley, is why “this is hitting apartment buildings and other types of real estate so hard.”

Freeman may not be hurting for money. 2025 news reports announced his contract with the Dodgers as being a six-year, $162 million deal. Prior to his arrival in Los Angeles, Freeman played for the Atlanta Braves, where he also had a large contract.

Still, Shelley said this is a big issue for many people.

“It impacts housing development, which is what it really affects, apartment buildings in particular, because they can't get financing at the terms that they would otherwise be able to get them because if it goes into foreclosure. And they have to put it on the market to sell it - 5.5% right off the top goes to the city government if it's in their price range, over $10.6 million,” said Shelley. “So it has really frozen the Los Angeles real estate market as far as the apartment development is concerned, and it's not done any good for the people in the Pacific Palisades, who were burned out of their property.”

Shelley said “even the damaged houses are more than $5,000,000, leaving the owners to pay the tax."

All because of what Shelley described as an awful, ill-conceived tax that was written by the people who are going to get the money.

“This is a new thing we've got going on in California, where the courts have said that special interest groups can write their own taxes, collect the signatures to put them on the ballot and evade the constitutional requirement for a two-thirds vote,” said Shelley. “The special taxes in California are supposed to go on the ballot for two-thirds vote at the local level. What the courts have said is if it's a citizens initiative, then that doesn't apply, which they pulled right out of the air.

"And now every special interest group is writing its own tax increase, and they're going to be able to pass them with a simple majority, which is insane," she said.

Shelley added that a so-called mansion tax to get money for services that help the homeless or people in trouble sounds good. “But as we've seen, the money is intercepted by these Minnesota-style NGOs that somehow wind up with really nice cars and houses themselves and not helping the people so much.”

Shelley is not alone in her criticism.

Steven Greenhut with Pasadena-based Pacific Research Institute called it a law of unintended consequences.

“It was supposed to create a lot of money for homeless programs, and it has been funding some of those programs. But what's really happened is people have stopped selling buildings, and they've stopped building apartments in Los Angeles,” Greenhut told The Center Square. “Los Angeles desperately needs more housing supply.”

Media reports have shown a decline in construction of new apartments in Los Angeles. In April 2025, UCLA’s Lewis Center for Regional Policy Studies published a report on the “unintended consequences” of Measure ULA.

“Our strongest evidence suggests it was particularly pronounced for non-single-family transactions,” said Greenhut, quoting the UCLA report’s authors. “So it’s not just mansions. It applies to commercial, industrial, multi-family properties.”

According to Ballotpedia, Measure ULA passed with 57.7% approval.